Long Wealth Capital has recently entered the trading mentorship scene, led by Darold Trinh—a name emerging in trading and online wealth-building discussions.

With people searching for more ways to make money from home and social media flooded with success stories and profit screenshots, trading mentorship programs are seriously getting attention.

But for every legit educator, there are plenty that miss the mark, and it seems like another “wealth system” launches every single week.

So is Darold Trinh’s Long Wealth Capital actually worth your time and money, or just another flashy program making promises that don’t hold up?

Here’s my full, honest look at Long Wealth Capital: what it really is, what you get, the good, the questionable, and some straightforward alternatives if you’re serious about learning to trade or building income online.

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

What is Long Wealth Capital?

Long Wealth Capital promotes itself as a trading education brand giving people “real mentorship” and step-by-step guidance designed for success in trading.

The main focus centers on options and stock trading, with a bit of content on futures and mindset, too. The company prioritizes education, coaching calls, market analysis, and community support rather than just slinging you signals or pre-made trades.

According to their website and marketing materials, Long Wealth Capital is open to anyone—from total beginners clueless about candlestick charts to advanced traders craving fresh strategies.

Their core offer is direct mentorship: you gain access to live calls, community chats, and a structured course library. This approach supposedly keeps you from the rookie mistakes, saves you money and frustration, and helps you reach profitability faster than flying solo.

The program’s founder, Darold Trinh, acts as the main instructor and CEO. His videos and personal story are featured front and center on the website and across all sales channels, which at least signals there’s a real person behind the operation. By contrast, many similar programs stay anonymous, so having a named founder is a leg up on transparency.

On the business side, Long Wealth Capital operates as a membership—you pay for access, get ongoing training, attend group calls, and interact with a community of fellow traders.

The pitch is you’ll get the benefit of direct access to Darold’s trading lessons (including the wins and the blunders), shortening your path to real profits.

Recommended Reading: Traders Alliance By Bryan Bottarelli Review – Is It Worth Joining For Stock & Options Alerts?

How Does Long Wealth Capital Work?

You’ll notice a familiar sales funnel: free webinars, intro videos, or Instagram ads nudge you to apply or book a call to discuss the flagship mentorship program.

Here’s how Long Wealth Capital lays out its process and what I found inside:

- Online Course Library: Once you join, a members’ area opens up with step-by-step video modules. These span the basics (trading terms, broker setup), intermediate strategies (chart reading, risk controls), and advanced market reviews.

- Live Trading Calls and Q&A: Live sessions feature Darold or his team going over recent trades, answering questions, and sharing what’s on their watchlist. Designed to mix real-time trading education with theory.

- Community Chat Groups: Groups (typically Discord or Telegram) for questions, trade discussions, sharing tips, and connecting with other members and coaches.

- Personalized Feedback: One marketing point is that you can submit trades, have them reviewed, and receive actionable feedback—aimed at keeping you from repeating expensive mistakes and helping you reach profitability faster.

Pricing, like most high-ticket mentorships, isn’t published upfront.

You’re invited to book a call to “see if you’re a fit.”

Based on buyer reports and leaked emails, pricing goes from $1,497 up to $4,997 for full mentorship, usually split into monthly payment options.

There’s sometimes an “intro” offer (one call or partial access) in the $197–$497 range, but the push is always toward the full, all-in package.

According to the company, you’ll have ongoing access after paying, with options to upgrade for more 1-on-1 time at higher prices.

Refund policies are murky—some buyers get told sales are final, while others report partial refunds if they act quickly and haven’t viewed much of the course.

The marketing angle is clear: “financial freedom,” leave your dead-end job, and build lasting wealth through trading.

Social media promotions are filled with profit screenshots, student wins, lifestyle photos, and the claim that mentorship is what separates successful traders from the rest. In a nutshell, it’s framed as a shortcut to trading glory—if you “work the system.”

Who is Darold Trinh?

Darold Trinh sits as CEO and public face of Long Wealth Capital. You’ll catch him on Instagram, YouTube, X (the former Twitter), and LinkedIn, sharing trading tips, memes, and boasting personal wins.

His own story?

Several years in the trading trenches, starting as a losing retail trader, then clawing his way to a “winning process” he now shares with mentees.

He’s part of a wave of Instagram and TikTok trading personalities, blending motivational posts and slick trade recaps. His content balances a youthful hustle vibe—showcasing cars, travel, and the freedom lifestyle—with a dash of technical trading education.

There’s no record of Darold working for big-name banks, hedge funds, or prop firms. He leans into the narrative of a self-taught, independent trader, toughing things out and building his own system.

When it comes to proof of results, things are a bit fuzzy. TikTok and Instagram clips show trade screenshots and recaps, but there’s no audited verification, broker-confirmed returns, or coverage in major finance media. This isn’t unique in the influencer trading world, but it doesn’t exactly add extra trust, either.

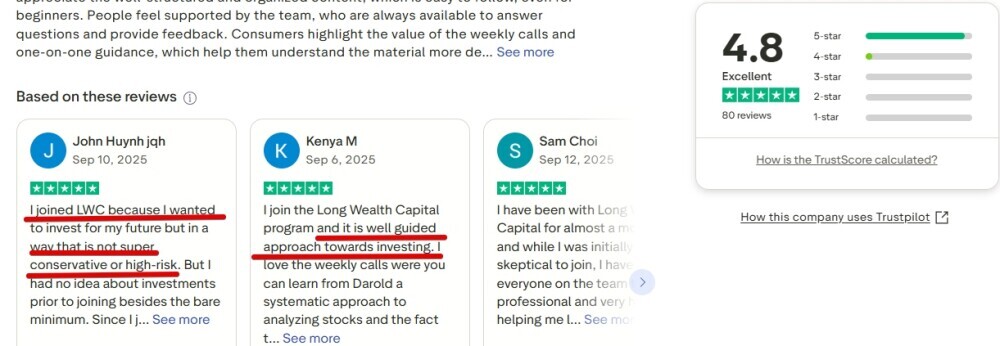

Some student testimonials highlight that his insights helped them lose less or even get profitable, but these mostly appear on his sales pages or own social channels. Fully independent reviews are rare, so keep your guard up with user results you see in tightly controlled spaces.

Pros of Long Wealth Capital

Here are a few points where Long Wealth Capital could add value, especially for new traders:

- Active Community and Support: Interacting with others on the same learning curve helps motivation and makes solo trading less lonely. The chats are useful for quick questions and accountability.

- Organized Learning Path: The stepwise video modules guide you neatly from basics through more complex topics. For those new to trading, this organized structure beats piecemeal YouTube hunting.

- Regular Live Calls: Being able to jump into live calls and ask real-time questions is a big plus—especially for those wanting feedback as situations unfold.

- Visible Founder: Darold attaches his name and persona to the business, sharing examples of trades. Compared to faceless programs, that’s a win for transparency to a degree.

- Easy Progress Tracking: The member dashboard keeps tabs on modules you’ve finished, which is nice for structure-focused learners.

For absolute beginners, being able to get things clarified—like order types or chart reading—matters. A mentor structure plus regular check-ins might speed up your improvement versus self-teaching with random internet advice.

Cons of Long Wealth Capital

There are clear drawbacks and warning signs (especially for those watching their wallets or looking for ironclad proof):

- No Third-Party Track Record: There aren’t any verified outside audits—no broker statements, no independent reviews—just testimonials found on their own web pages or Instagram stories.

- Price is Steep: At $1,500–$5,000 for the main mentorship, it’s a big commitment, especially for new traders. Spending your entire trading bankroll on mentoring (rather than real trading) could stall your learning curve.

- Hidden Pricing: Having to book a call only to have the price dropped on you later, coupled with hard sales tactics, is always a reason for pause.

- Hard-to-Find Independent Success Stories: There are a few wins shown off publicly, but finding transparent, third-party, long-term student results is tough. The space is crowded with lookalike programs touting massive profits, making it tricky to know what’s real.

- Murky Refund Policy: Refund info is unclear. Complaints on Reddit and Trustpilot mention difficulties getting money back—make sure you request details in writing first.

- Sales Language is Aggressive: Some messaging—“last chance, spots are closing,” alongside non-stop profit screenshots—can feel overdone or manipulative.

Versus traditional, regulation-heavy finance learning, these influencer-run programs sometimes boost the promise and gloss over hurdles. If you’re thinking about spending thousands, weigh whether the value lines up—especially if you’re new and have yet to develop your own trading edge.

Is Long Wealth Capital Legit or a Scam?

This is the crucial question for anyone about to spend serious money on a trading mentorship. My honest take, based on my experience, what I’ve dug up, and community chatter, is as follows:

- Long Wealth Capital delivers what’s advertised: real video lessons, community calls, an actual chat platform, and trading resources matching the sales pitch. It isn’t a scam where you pay and get nothing.

- There are satisfied customers (who have a good Trustpilot rating), who say the lessons helped them trade better or stay motivated.

- On the flip side, there are notable red flags:

- No independently verified performance: All results come from self-curated channels; there’s no third-party proof or broker audits.

- Hard-sell tactics: High-ticket sales calls, upsells, applications, and FOMO-heavy marketing are par for the course among programs that might value revenue first and foremost.

- Lack of regulation: The program is not reviewed by institutional educators or regulated advisory agencies. This is business as usual for modern social trading education, but it puts all responsibility for risk on you.

- Understand that no course or mentorship can guarantee profitability. Your results depend on your ability to absorb, practice, and emotionally handle risk when real money is on the line. A high price won’t substitute for experience, and you may get more value from reputable, affordable platforms as you build foundational skills.

Careful research is your best ally. Look for outside reviews, speak to independent graduates, and always get refund terms written down. If that’s hard to secure, better, clearer options exist—sometimes with more transparent pricing and student support.

Alternatives to Long Wealth Capital

The landscape for trading education is huge, but some alternatives stand out for value, transparency, and reputation. If you’re considering your options beyond Long Wealth Capital, here are a few places that consistently get high marks and positive user feedback:

- Investopedia Academy: Reasonably priced, beginner-friendly classes led by credible trading instructors. You get a structured approach without hype.

- Benzinga Trading School: Offers ongoing daily mentorship, regular interactive classes, and access to seasoned traders. Clear, upfront pricing—no high-pressure upsells.

- Warrior Trading: This brand is recognized for live trading, swing strategies, and an active member community. Pricing is high, but you get live access to actual traders and more in-depth resources.

- Udemy’s Trading Courses: Super affordable entry (sometimes under $50), transparent user reviews, and plenty of variety for self-directed learning.

- TradePro Academy: Covers futures, options, and equities at all levels, with reliable mentorship and well-supported member groups. Prices are posted—no calls required just for a quote.

Outside of trading, you might want to try other online income streams like affiliate marketing, content business, or e-commerce solutions.

These can generate passive income and don’t put your starting capital at risk with daily market swings.

Affiliate marketing platforms like Wealthy Affiliate are worth trying because they offer a true free option to start (no credit card required), years of credible reviews, and strong community support with straightforward upgrade options. You’re not pressured with sales calls, and you can go at your own pace.

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

Final Verdict

Long Wealth Capital—run by Darold Trinh—is a real, fully built trading mentorship. You get legit video content, community calls, and a named founder who’s publicly active. It’s not a “ghost” scam that takes your payment and vanishes.

However, the program charges a premium, uses aggressive marketing, and lacks third-party verified trading evidence. This style of program is more about high-pressure influence than industry oversight. Know you aren’t buying a fast track to riches, and trading capital isn’t included.

If you’ve got spare funds and value mentoring, community, and structure, you might find Long Wealth’s vibe matches your learning style—especially if you thrive on energy, group chats, and regular check-ins. But check your expectations: there’s no magic bullet, and it’s risky to dip into savings or emergency cash just to go “all in” on trading.

Do your research—ask for refund details in writing, contact outside past students, and check similar platforms for more transparent pricing and long-term support. For those just starting, tried-and-true or lower-cost programs like Wealthy Affiliate (for business skills) make more sense than leaping into a four-figure mentorship with unverified promises.

Test your trading skills on a demo account first, focus on real education, and don’t chase overnight breakthroughs.

Most wins take time and practice—and you’ll get farther by building a solid base instead of rushing into any high-ticket “secret system.”

If you want trustworthy tools and community with less hype, I recommend the following:

Best Alternative for Reliable Online Income: Get Started Here for Free (No Card Needed)

Dive into affiliate marketing or building content businesses—it’s lower risk and lets you go at your own speed.

With a truly free trial and years of public feedback, it’s a much safer starting point for most. Trading could pay off, but slow is fast, and prioritizing education over hype will put you ahead in the long run.

Reach out with any questions—I’m always glad to help.

Regards and Take Care

Roopesh