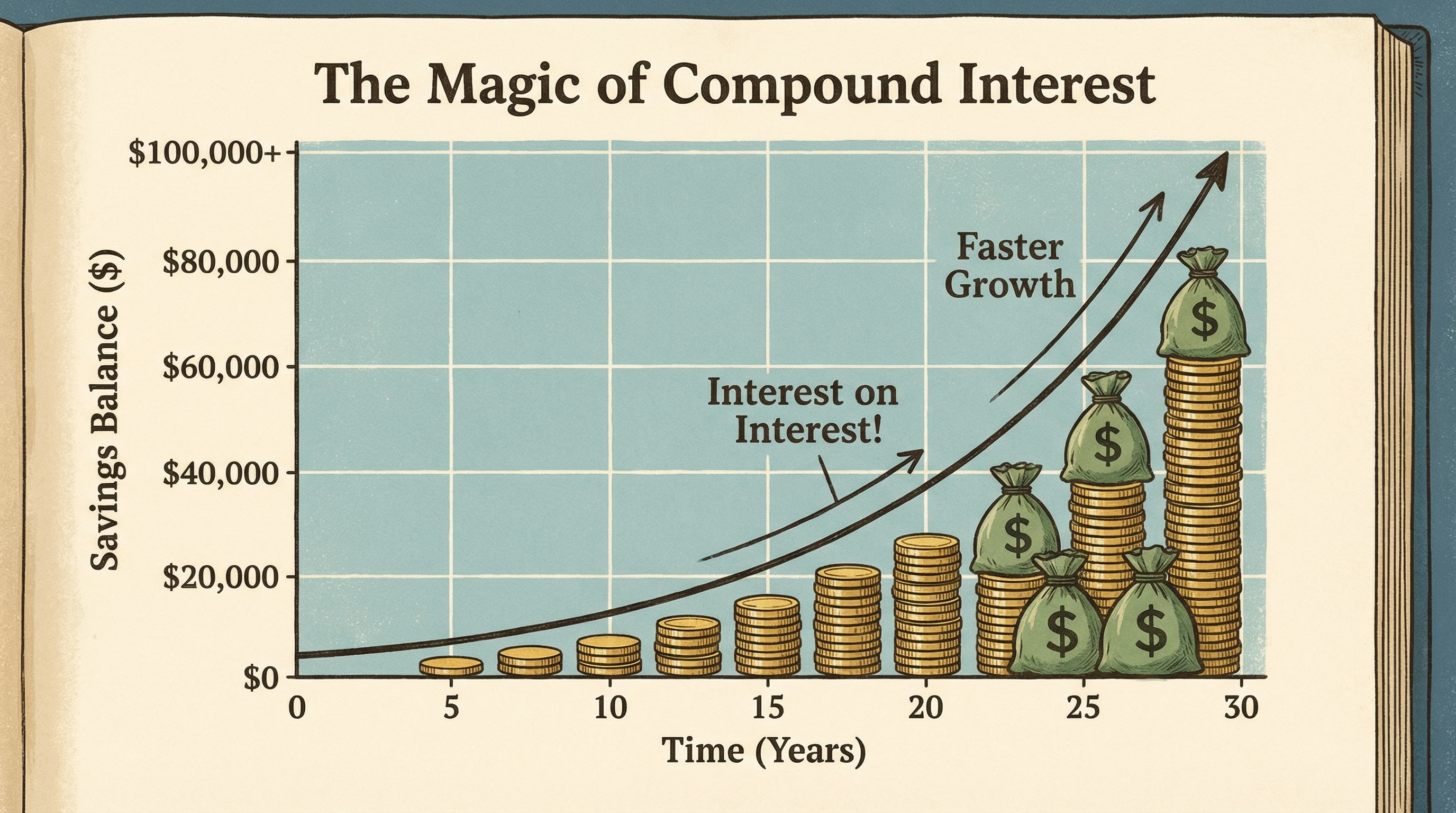

Compound interest is often called the “magic” behind savings growth, but a lot of people find the details confusing.

It’s basically the process that lets your money earn even more money over time, creating results far beyond what you’ll see with a standard piggy bank.

If you’re saving for a major goal or just wish your hard-earned cash would do a little more, knowing how compound interest works is a big advantage.

I like to keep things clear and simple—no business school degree required. I’ll walk through what compound interest actually means, how it really works in different savings accounts, and why even small changes (like how often your interest is added) can seriously boost your results.

You’ll see straightforward examples to help break it all down, plus practical tips for getting the most out of compound growth.

By the end, you’ll be ready to put these insights to work, grow your savings smarter, and confidently make choices that help your money stack up faster.

Compound Interest Explained. No Jargon Needed

At its core, compound interest means you earn interest not just on your original savings (the principal), but also on all the interest that’s already built up along the way.

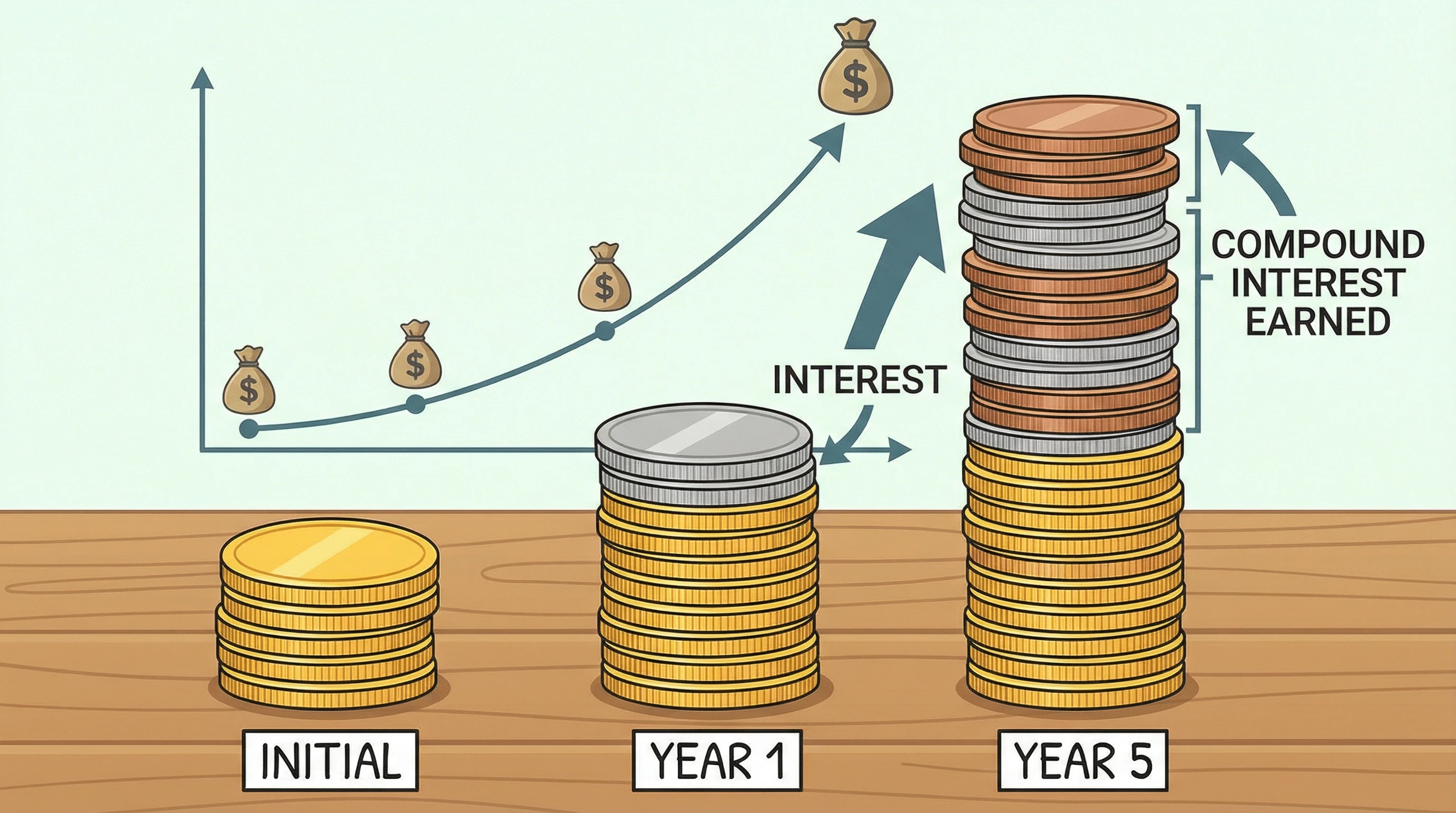

Let’s say you put $1,000 in a savings account.

If you earn $50 in interest, next time, you’ll get interest on $1,050—it’s money working on money. Each new bit of interest gets rolled into your balance, so the next round earns you a bit more.

That’s the compounding process at work.

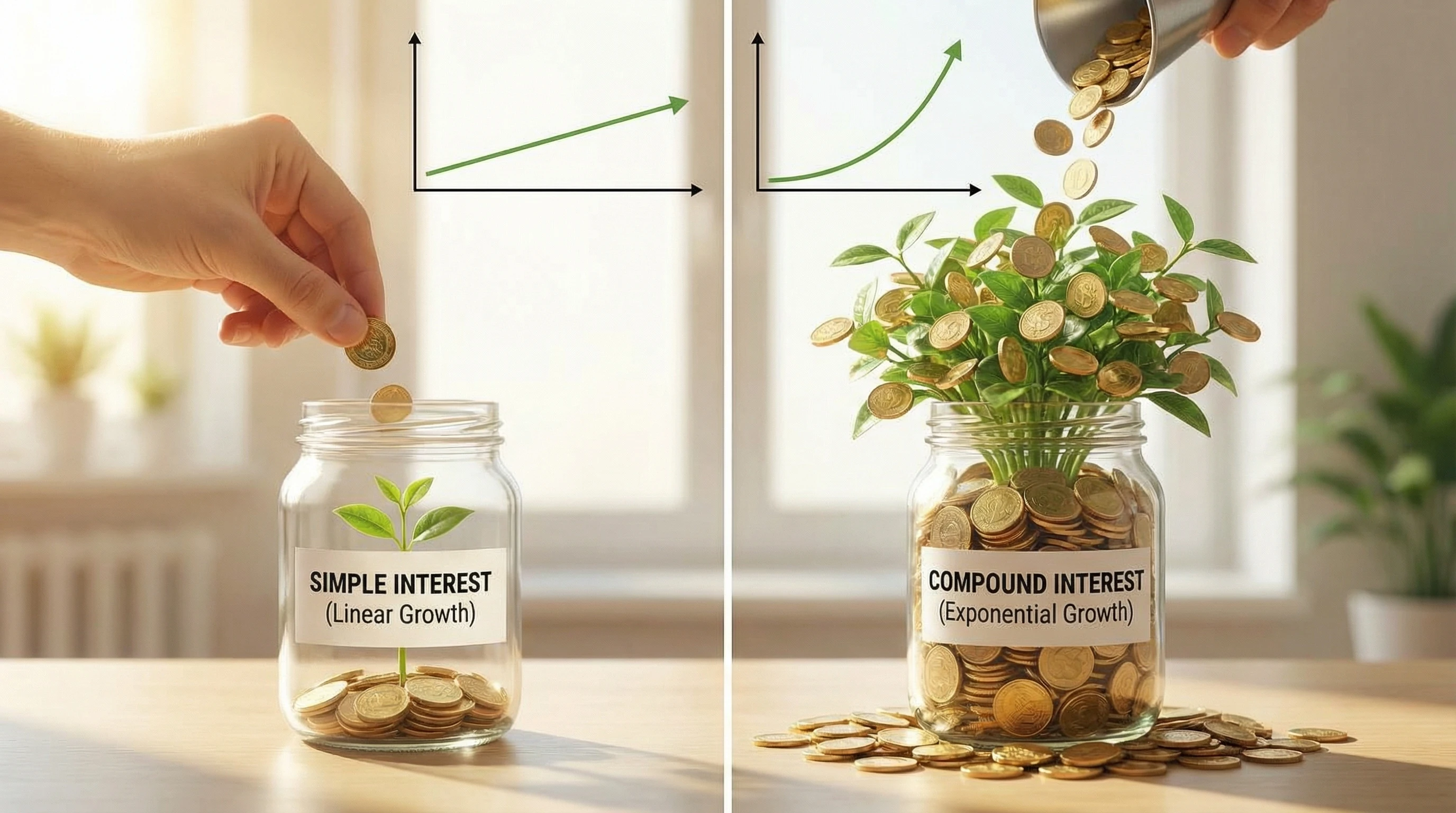

With simple interest, a bank pays you only on your original deposit—never on the interest you’ve earned before. But compound interest lets your money snowball and grow exponentially.

Over time, that snowball can turn into something substantial. The longer you leave your money in the account, the more it multiplies. This is what makes compound interest the secret behind real savings growth; it rewards patience in a way that simple interest just can’t.

How Compound Interest Works in a Savings Account

Banks and credit unions often use compound interest to encourage saving, and they keep the mechanics simple.

They pay out interest on your account balance at regular time intervals. The frequency at which interest is added—called the compounding frequency—is a detail that can make a big difference over the years.

- Daily compounding: Interest is calculated and added to your balance each day, so your savings grow incrementally every day.

- Monthly compounding: Interest is added once per month—12 times each year.

- Annual compounding: Interest gets added only once per year, making your money grow the slowest among these options.

The more frequently your interest compounds, the quicker your balance stacks up. When frequent compounding combines with time—especially years—compound interest can deliver eye-catching results.

Even moving from annual to monthly or daily compounding will let your savings grow noticeably faster.

Most banks list their compounding method alongside posted rates, so it’s always smart to look into this when choosing an account.

Simple Interest vs Compound Interest: What’s the Real Difference?

The difference between simple and compound interest is hugely important when deciding how to save.

- Simple interest: You earn interest only on your initial deposit, or principal. If you put $1,000 in at 5% simple interest for three years, you’ll get $50 per year, which totals $150 over three years. The growth is steady and predictable.

- Compound interest: You earn interest not only on your initial deposit, but also on every bit of new interest as it comes in. After the first year, you have $1,050. The next year, you earn 5% on $1,050, and it keeps on growing from there. Over three years, you’ll get more than $150 total interest, as each cycle builds on the last.

This difference gets exponentially larger over time. For long-term savers, compound interest is the game-changer. Layering your earnings on top of earnings is powerful—years down the road, this is how people build wealth through saving, even if their deposits always stay modest.

Recommended Reading: How To Manage Credit Card Debt Effectively For Beginners

Key Factors That Influence Compound Interest Growth

Interest Rate

Even a small difference in the annual interest rate can make a serious difference, thanks to compounding. Higher rates mean each round increases your snowball just a little bit more, boosting future earnings. That’s why it pays to shop around for the best compound interest savings account rates from established banks or credit unions.

Time

Time does most of the heavy lifting, so starting to save early is one of the smartest money moves you can make. Even a modest deposit can become much larger over long periods, because compounding works its magic with every cycle. Waiting just a few extra years can mean leaving a big chunk of growth on the table.

Compounding Frequency

The more often interest is calculated and added to your account, the better. Daily compounding means more growth than monthly, which is better than annual. Over the course of many years, compounding more frequently can have a real impact—especially on bigger savings balances.

Regular Contributions

Adding new money to your savings every month or every paycheck means more fuel for the compounding engine. These fresh deposits instantly jump into the compounding process, making all your savings grow that much faster. Small, regular contributions go much farther for your future than you’d expect.

How Compound Interest Grows Money: Two Clear Examples

It’s helpful to check out real numbers to really make sense of how compound interest works. Here are two examples to show you how savings can build up.

Example 1: Lump Sum Savings (No Extra Deposits)

Suppose you put $2,000 into a savings account at 4% APY, compounded monthly. You don’t make any more deposits after the initial amount.

- After 10 years: $2,984

- After 20 years: $4,451

Your money more than doubles on its own, just by sitting in the account and letting compound interest work over time. That’s the real beauty of patience and sticking with your goal.

Example 2: Monthly Contributions

If you start with $500 and put in $50 every month to a savings account with a 4% compound interest rate (monthly compounding), here’s what it might look like:

- After 10 years: about $7,395

- After 20 years: about $15,186

Sticking to consistent deposits gives compounding much more to build on. The secret isn’t making one giant deposit; it’s about keeping up with regular, habitual savings over time.

Key takeaway: The real power of compound interest comes from steady, slow-and-steady contributions and not touching your savings unless you really need to.

Best Accounts to Earn Compound Interest on Your Savings

Ready to set compound interest to work?

There are several account types where you can let your money grow while keeping risk low. As always, make sure to look over the terms of any account you’re interested in:

- High yield savings accounts: These accounts, especially at online banks, usually give much better rates and frequent compounding than traditional savings (no risky investments required).

- Money market accounts: Often pay higher rates than normal savings, but might need a larger starting balance. These accounts are a middle ground between checking and savings.

- Fixed deposits or certificates of deposit (CDs): Locking in your money for a set period (often six months, a year, or more) can get you a higher rate with monthly or quarterly compounding.

- Tax-free savings accounts (like TFSA, Roth IRA): In some countries, these let your money grow with compound interest and keep your gains tax-free, which can massively boost results over time.

Remember, these accounts are designed for safe, steady growth—no get-rich-quick promises, just reliable accumulation.

Your main risk here is inflation, which can eat away at savings gently over the years, so always look out for the best rates.

Common Compound Interest Misunderstandings

There are some popular myths and traps people fall into when it comes to compound interest:

- “Compounding makes you rich overnight”: Not really. The biggest growth comes in the later years—early on, it might feel slow and not all that impressive.

- “It always beats inflation”: Sometimes savings rates lose out to rising prices. If your account earns less than the inflation rate, your money loses value in real life.

- “Taking money out doesn’t matter”: Every time you withdraw funds, you shrink your future growth. Every dollar left in the account keeps compounding; every dollar you take out stops working for you.

- “All savings accounts pay compound interest”: While most do, some older or specialty accounts stick with simple interest. Double-check before you sign up.

The biggest wins with compound interest always go to those who stick with it for the long haul and aren’t tempted to pull savings out for short-term desires. Patience and consistency are key.

Tips to Maximize Compound Interest Growth on Your Savings

- Start early: Time is everything. Even a couple of extra years at the start can turn into thousands of extra dollars later on.

- Contribute regularly: Set up an automatic transfer each month so you never forget. These new deposits feed the growth machine.

- Leave your savings untouched: Letting your money sit means every bit of interest keeps building on itself.

- Reinvest your interest: If your account gives you the option, reinvest all earned interest right back into your savings to keep compounding at full strength.

- Compare accounts: Look for the highest reputable rates, watch for fees, and check compounding frequency to get the most out of your account.

Think of it like tending a garden—watering it with regular deposits and letting time take care of the rest. You might not see rapid growth in the first season, but give it a few years and the rewards will stand out.

Compound Interest vs Growing Income (and How Real Results Happen)

Turning to compound interest is a classic way to let your money work for you on autopilot.

Still, it’s not a get-rich-quick answer.

Big results come from stacking smart saving habits with other financial moves. Many people combine saving with growing their income—side hustles, business ventures, or developing new work skills—so they can make bigger deposits and speed up their money’s growth.

If you want to get ahead, the magic really happens through both growing your income and steadily saving.

Those who reach their goals usually use a combination: they put aside money steadily, keep it compounding, and add to their savings as their earning power grows.

Savings are important, but sometimes earning more is the missing piece.

If boosting your income while building savings sounds good, check out my recommended online business training platform.

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

It’s a training platform called Wealthy Affiliate. The training they offer is perfectly suited for newbies wanting to build an online asset and enter the world of online entrepreneurship.

Wishing you everything of the best in earning compound interest.

Good Luck

Roopesh