Building a balanced investment portfolio sounds like something just for financial pros, but actually, it’s a game-changer for beginners looking to grow wealth over time without running into major headaches.

Most people who struggle with investing aren’t failing because they’re lazy or don’t want it badly enough.

It’s usually because their investments are completely out of balance. It’s way too easy to get caught up in the hype or put all your money into one shiny stock and then panic when things go south.

Why Putting Everything in One Asset Can Trip Up Investors

Dropping your entire savings into just one type of investment, like a single stock or some hot new cryptocurrency, is tempting but risky.

If that asset takes a hit, so does your entire portfolio.

Sometimes, it takes years to recover. This is why even investors who work hard and follow the news closely still end up with roller-coaster results.

There’s just too much on the line.

What a Balanced Portfolio Actually Is

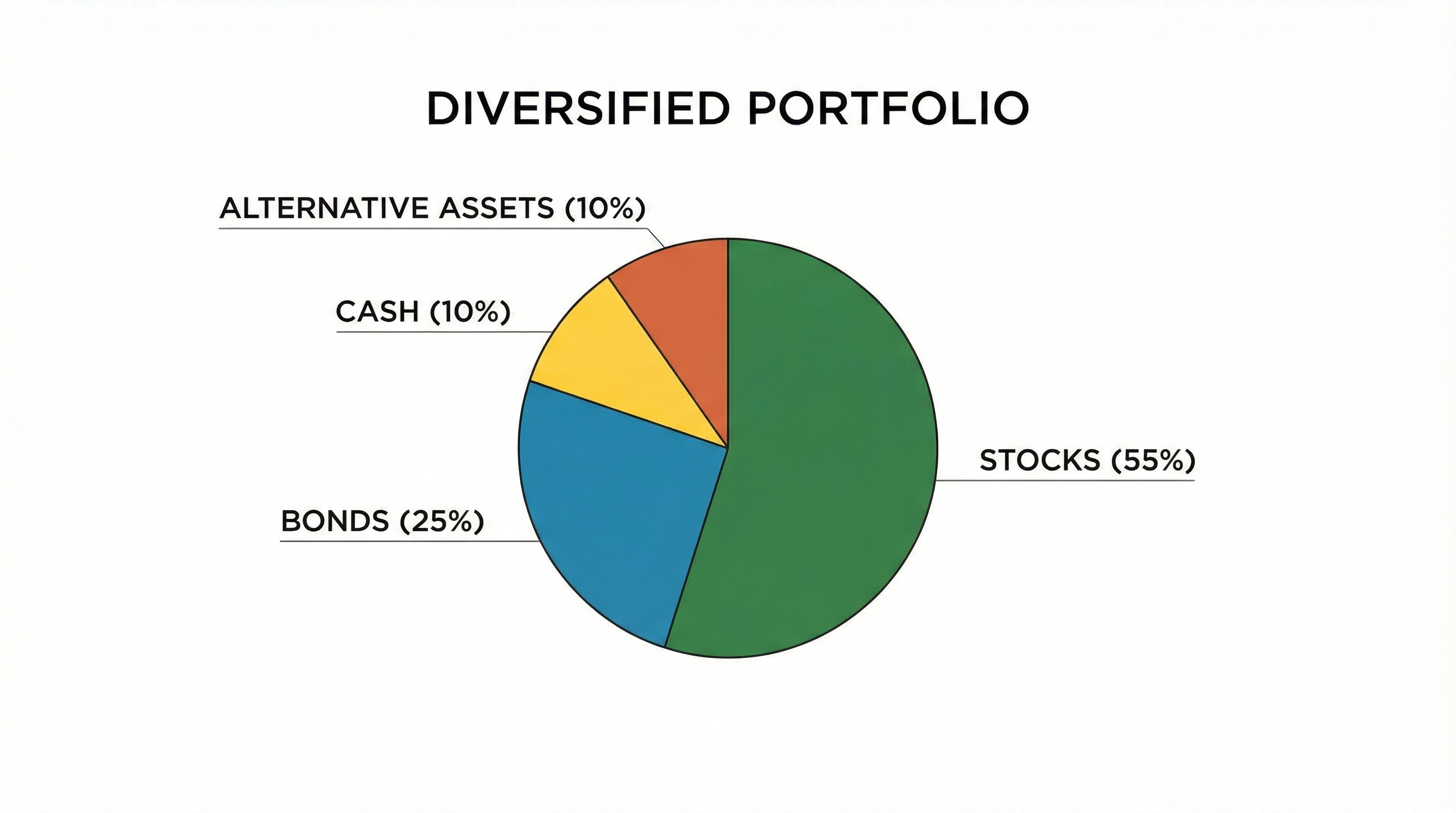

A balanced investment portfolio basically means spreading your money out across different types of assets, so your risk is not tied to just one place.

Instead of dumping everything into stocks or picking the latest buzzy investment, you mix things up across stocks, bonds, cash, and sometimes even alternatives like real estate or gold. The goal is to grow your nest egg steadily and not get wiped out by one bad market swing.

This guide covers what it really means to keep things balanced, breaks down the different assets you can use, and shows how you can set yourself up for steady, long-term growth—even if you’re just starting out.

You’ll also learn strategies to stay the course and avoid the common pitfalls. Balance means being comfortable enough to stick with the plan through ups and downs, so you don’t make costly emotional decisions in the heat of the moment.

What Is a Balanced Investment Portfolio?

In plain English, a balanced portfolio is a mix of several different types of investments, such as stocks, bonds, cash, and sometimes alternatives.

This way, you’re not betting your future on just one thing. Each type of investment brings its own risks and rewards, but when you combine a few, the ups and downs have a way of smoothing each other out.

While the idea of earning the highest possible return is exciting, searching only for the biggest gainers usually leads to more stress and sometimes big losses.

A balanced approach is more about getting decent, steady growth and avoiding big setbacks than hunting for huge wins every year.

Long-term investors focus on riding out the ups and downs, not hitting home runs every month. Having that longer view means you can be more patient and avoid panicking when the market gets bumpy, which is pretty common. Building this habit now pays off over decades, not just in the next few months.

Why Long-Term Growth Needs Portfolio Balance

Markets go up and down.

That’s not a bug, it’s just how things work.

Stocks might soar one year and drop the next, and even safe-feeling investments like bonds lose value sometimes. When all your money is tied to one asset and a wobble hits, that’s when regrets start piling up.

Mixing different asset types in your portfolio is like having a safety net. If one area slips, another can pick up the slack. Over the years, balance helps protect your gains so one mistake or bad year doesn’t set you all the way back to zero.

Having a mix of assets also puts time on your side.

A well-diversified portfolio, left mostly alone, grows as markets recover from setbacks and as the power of compounding takes effect. The combination of patience, balance, and smart allocation is super important for building wealth over time. If you reinvest your gains and make regular contributions, the growth snowballs.

Recommended Reading: Beginner’s Guide To Investing In Crypto: How To Start Safely And Smart

Core Asset Classes Every Balanced Portfolio Uses

- Stocks (Growth Engine)

Stocks are the part of your portfolio that help everything grow.

When you buy stocks, you’re becoming a partial owner of a company. As companies grow, their stocks usually go up over time. Stock index funds, like those tracking the S&P 500, spread your money across lots of different companies, so you’re not betting on just one business.

Picking individual stocks can be fun, but for most beginners, keeping it simple with index funds or broad ETFs helps reduce stress and keeps things steady. Index funds are a popular way to stay balanced without having to research individual companies every week.

- Bonds (Stability Layer)

Bonds act as the cushion in your portfolio. When you buy a bond, you’re basically loaning money to a government or a company, and they pay you interest for it. Bonds don’t have wild ups and downs like stocks, and usually, they’re steadier. This helps balance out risk and lowers the chances you’ll lose big during a rough patch.

You’ll notice that the older you get or the closer you are to needing your money, the more important bonds tend to become. They keep you grounded when the market party turns into a hangover.

- Cash & Cash Equivalents

Cash in your portfolio isn’t exciting, but it’s really useful for emergencies, surprise expenses, or grabbing an opportunity when markets dip. Cash equivalents include highyield savings accounts, money market funds, or certificates of deposit (CDs). The main benefit here is liquidity, which basically means you can access your money pretty fast without penalty.

It’s not about earning massive returns; it’s about easy access to your funds when you need them.

- Alternative Assets (Optional)

Once you’ve got the basics covered, it can be helpful to dabble in alternatives on a small scale. These might include:

- Real estate funds or REITs (for property exposure without buying a building)

- Commodities such as gold or silver (tend to act differently than stocks or bonds)

- Cryptocurrency (can be very volatile, so only a small allocation for most beginners)

Alternatives can add an extra layer of diversification, but for most beginners, a heavy focus on stocks, bonds, and cash is the smarter move. As you gain confidence and larger assets, you can mix in alternatives to round out your exposure.

How to Choose the Right Asset Allocation

Asset allocation is just the process of deciding what percentage of your portfolio goes into each asset type. Your age, risk tolerance, and how long you can leave your money invested all play a part.

Age-Based Allocation

A common guideline is “the younger you are, the more stocks you own” since you have more time to recover from downturns.

As you get closer to needing your money, you generally switch more toward bonds and cash. One shortcut people use is “110 minus your age equals your stock percentage.”

So if you’re 30, you might put around 80% in stocks. But this is a rule of thumb, not a strict requirement, and should be adjusted to suit your comfort and goals.

Risk Tolerance: How Much Bouncing Around Can You Handle?

Risk tolerance is about how much loss you’re comfortable seeing on your balance before you start losing sleep.

If big drops make you anxious, more bonds and less in stocks usually works better for you.

If you can shrug off losses and wait for years, you may favor more stocks.

Take time to honestly assess your reactions to market dips so your portfolio matches your comfort level. If you’ve never invested before, start cautiously and observe how you feel during the inevitable bumps.

Time Horizon: Patience Matters

The longer you can leave your money invested, the more risk you can generally take.

If you’re planning for retirement that’s 30 years away, you have time to recover from tough years. If you’ll need your money soon, staying safer with more cash and bonds helps.

Consider what you’re investing for. Big expenses like a house down payment or college fund should be safer if you’ll need them within a few years. For retirement funds, being aggressive with stocks makes more sense if time is on your side.

Sample Portfolio Allocations

- Conservative: 40% stocks, 50% bonds, 10% cash

- Balanced: 60% stocks, 30% bonds, 10% cash

- GrowthFocused: 80% stocks, 15% bonds, 5% cash

Nobody’s situation is exactly the same, so it helps to play with these numbers based on your own needs and goals. Review your allocation every year or after big life changes to be sure it still feels right.

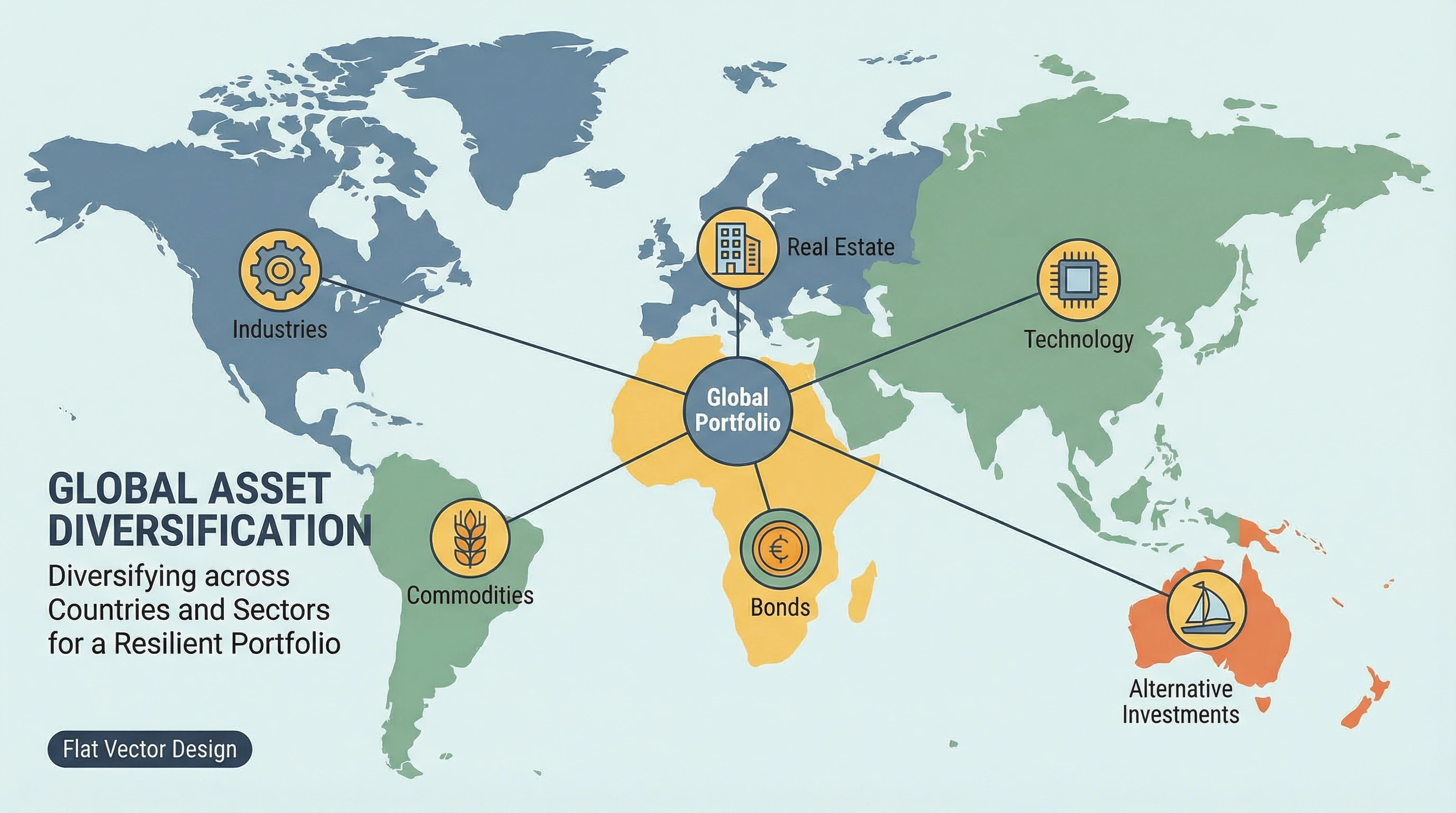

Diversification Explained (Without the Jargon)

Diversification is just a fancy word for “don’t put all your eggs in one basket.”

By owning lots of different investments, you lower the chance that one bad bet destroys your savings.

Spreading your money across various assets, sectors, and even countries can help you get more consistent results. For example, you might mix US stocks with international stocks, or add real estate alongside your bonds. This way, if one area is struggling, there’s a good chance another is holding strong or even doing better to pick up the slack.

Let’s say tech stocks slump but healthcare or energy is rising. Making sure your portfolio has a little bit of each means a setback in one area won’t ruin your whole plan.

Domestic vs. International Exposure

Investing only in your home country feels comfortable, but it also means you’re missing out on possible growth overseas.

Most experts suggest having a chunk of your stock portfolio (maybe 20-40%) in international investments to keep your balance better protected. Foreign economies don’t always move in sync with your own, which helps smooth the ride even more.

Sectors and Geographies

Owning all tech stocks might work for a while, but if that area hits a rough patch, things can get ugly. Better to mix in companies from other industries like healthcare, consumer goods, energy, and so on. Also, include companies from different regions around the world.

How Often Should You Rebalance Your Portfolio?

Rebalancing means moving money between your investments to get them back to your target percentages.

For example, if stocks do well and suddenly make up 75% of your portfolio (when your goal was 60%), you’d sell some stocks and add more to bonds or cash to level things out.

Most people only need to rebalance once or twice a year. Some choose to check quarterly, but more frequent changes usually aren’t needed and can add up fees. If your target mix drifts more than about 5-10% from your plan, it’s a good time to adjust things. During big market swings, it’s tempting to overreact, so try to stick to your schedule for more stable results.

And sometimes, if your investments haven’t shifted that much, it’s totally fine not to rebalance at all. Emotional decisions during market chaos often make things worse, so having a steady routine is really important. Consider setting calendar reminders or using portfolio tools to help keep track.

Common Mistakes to Avoid When Building a Portfolio

- Putting Too Much in One Asset

Say you hear about a hot stock or crypto that’s “going to the moon.” It’s easy to feel like you’re missing out if you don’t pile in. But overinvesting in just one thing can turn a small mistake into a disaster.

- Chasing the Latest Trend

Jumping into whatever’s popular in the news rarely works out over the long haul. By the time you hear about a big winner, it may already be overhyped and overdue for a dip.

- Ignoring Fees

Account fees, fund expenses, or trading costs don’t seem like a big deal day to day, but over years, they eat into your returns. Always check how much you’re paying and look for low cost funds and platforms where possible. Even a half percent difference in fees adds up over the long term.

- Emotional Buying and Selling

Panicking during downturns or getting greedy when prices rise leads to buying high and selling low. This is the total opposite of the wealthbuilding game. Having a plan and sticking to it helps avoid this trap. If you find yourself tempted to make sudden moves, pause and take a breath before taking action.

- Not Having a Clear Plan

Wandering from investment to investment without a real strategy makes it much harder to stay consistent or know what to do during tough times. Setting a basic plan and writing it down, even just a few lines, keeps you focused on the long run. That plan doesn’t need to be fancy. Just track your target allocation and big-picture goals, so you know when things are on track or need a small course correction.

Long-Term Growth vs Short-Term Speculation

Time after time, it’s the folks who focus on steady, long-term investing who wind up better off. Chasing hype, trying to time every market bounce, or hoping for quick wins leaves most people frustrated and offtrack.

Short term speculation might work out for a lucky few, but for nearly everyone else, patience and consistency pay off best.

Even legendary investors like Warren Buffett preach the power of holding good investments for years, not days or weeks, while letting the magic of compounding do its thing.

Every dollar you leave invested has the potential to earn more, and then those gains can earn more—compounding is your secret weapon for wealth.

Can Beginners Build a Balanced Portfolio?

It’s totally normal to start small.

Most people don’t have huge sums ready to invest on day one. These days, with fractional shares and low cost investing apps, you can start with even a few bucks.

There’s also a bunch of tools for beginners to help keep things balanced without getting overwhelmed. Robo-advisors are one option.

They automate the process of choosing investments and make adjustments for you based on your risk tolerance and goals.

Apps like Betterment, Wealthfront, or major brokerage platforms such as Vanguard, Fidelity, and Schwab all have setups that make it much easier to build and maintain a balanced mix.

Learning the basics of investing is way more useful than getting swept up in complicated schemes or “can’t-miss” tips.

Focusing on real education—like books, beginner workshops, or respected online courses—pays off tons more than trying to outsmart Wall Street on your first try. Knowledge is what gives you the confidence to stick with your plan, especially when things get rough.

Building Wealth Is a System, Not a Shortcut

Building long-term wealth works best when you treat investing as a simple, ongoing habit rather than a quick thrill.

Keeping your portfolio balanced, making steady contributions, and not sweating every shortterm bump is what actually adds up over time.

Every smart, informed move is a step forward, even if it feels a bit slow in the beginning.

The combination of balance, patience, and sticking to your plan is basically the recipe for long-term growth. The sooner you get these habits down, the sooner you set yourself up for a strong financial future. That way, you won’t get washed away by the next big market wave or hype cycle.

Want to Learn How Real Wealth Is Built?

Before investing more money, check out how income, investing, and planning can work together for you.

- 🎥 Free masterclass videos from sevenfigure earners

- 📘 An easy-to-follow guide for making your first investments

- 🚀 Solid for anyone wanting more control over their financial path

Access your free training bundle here

Wishing you everything of the best in your investment journey.

Regards and Take Care

Roopesh