Ever feel like your income disappears before the month ends? You’re definitely not alone; so many people set out to manage their money, only to find that the numbers just aren’t adding up by the last week of the month.

I’ve learned that when I started using a simple system to separate my needs, wants, and savings, the fog around my finances really started to clear up.

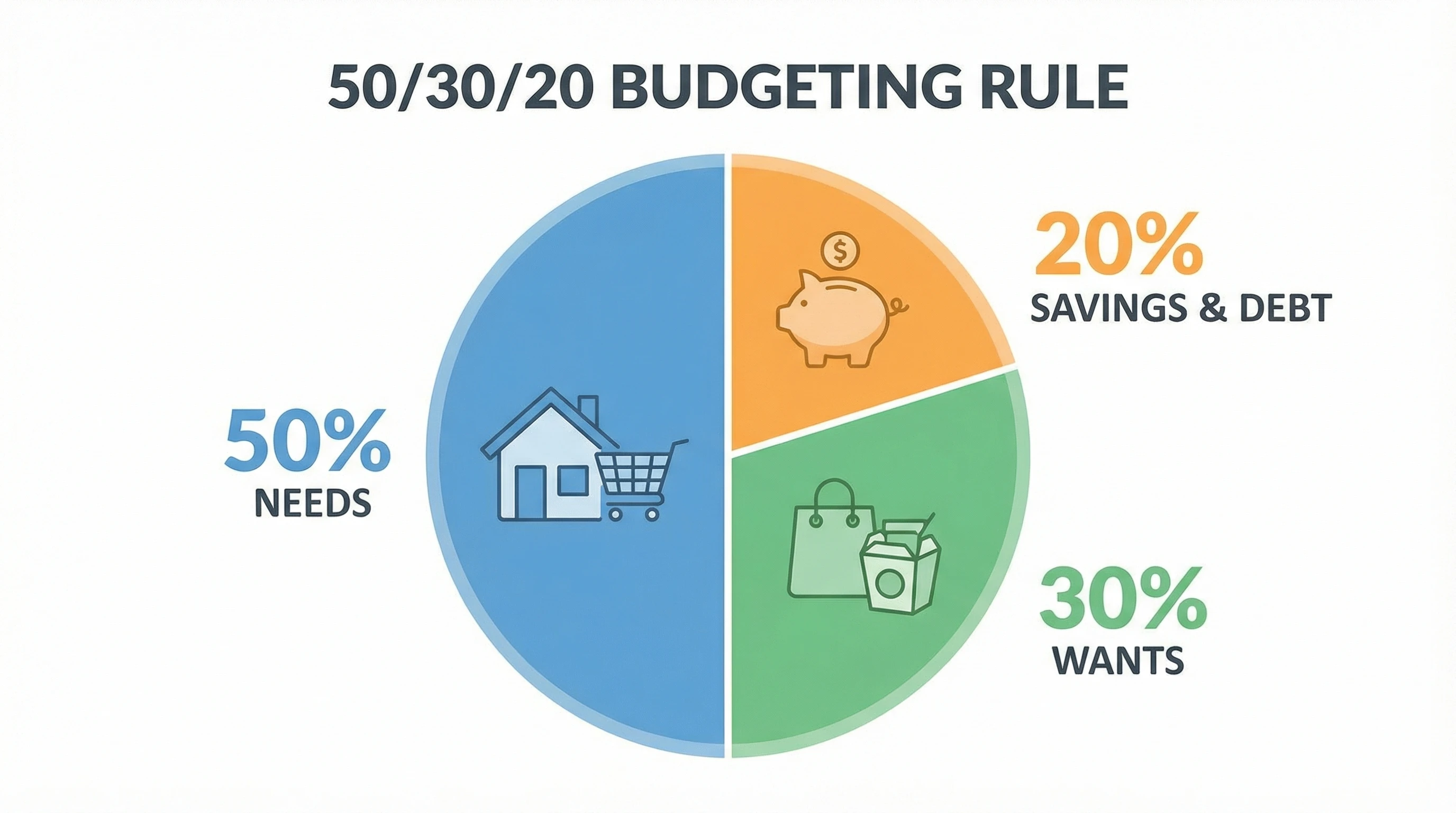

This guide is all about building a monthly budget using the 50/30/20 rule. If you’ve been searching for a monthly budget template or practical budgeting tips, you’re in the right place.

I’ll take you through what this rule means, walk you step by step through how to break down your income, and share real examples to show you how it looks in action. Plus, I’ll suggest some free apps and worksheets to help you stay organized and actually enjoy the process!

What Is the 50/30/20 Rule?

The 50/30/20 rule budget is a super approachable framework that helps you divide your monthly income into three clear buckets: needs, wants, and savings (plus debt repayment, if you have any).

The best part is, you don’t need a finance degree or accounting skills; just a willingness to honestly look at your spending.

- 50% to Needs: This chunk covers bills and expenses you can’t live without. Think rent or mortgage, groceries, insurance, utilities, and minimum loan payments.

- 30% to Wants: Here’s where you budget for the extras that make life fun, like a streaming subscription, meals out, vacations, that daily coffee run, hobbies, or new tech gadgets.

- 20% to Savings & Debt Payments: This money goes directly toward building your future, whether that’s saving for an emergency, putting money into investments, or paying off debt faster.

It’s really straightforward, and it can help you see where your money actually goes each month. I’ve found it works whether you’re living on an entry-level salary or bringing in a bit more.

Why the 50/30/20 Rule Works

The first time I tried budgeting, I made it way too complicated.

The 50/30/20 rule stood out for keeping things simple and flexible. It’s not about strict categories with fifty budget lines; it’s about understanding your big picture and creating solid habits that stick.

- Beginner Friendly: You don’t need tons of experience or time to get started. This system is easy for anyone to pick up and run with.

- Flexible & Forgiving: Your needs and wants might look different from mine, and that’s totally fine. The percentages give you breathing room to personalize things.

- Works for Any Income: Whether you bring home $2,000 or $10,000 a month, the rule still adds up. Just adjust the dollar amounts, and you’re set.

- Helps You Avoid Overspending: This structure helps you spot when you’re drifting into overspending territory, especially on wants.

- Boosts Savings: Putting aside 20% for savings and debt every month helps build your emergency fund or crush debt faster.

Sticking to it isn’t about being perfect every month. It’s about having a plan that works with your life and helps you keep moving forward.

Step-by-Step: How to Build Your Monthly Budget

Step 1: Calculate Your Net Monthly Income

Start by figuring out your take-home pay; that’s the money that lands in your bank account after taxes, insurance, and any retirement contributions are deducted. If you have a side hustle or earn tips, try to estimate the average you expect to receive each month.

Why net income and not gross? Because net income is the real money you can actually spend and save. Planning with your before-tax income could leave you constantly coming up short.

Step 2: List Your Monthly Needs

This is where the rubber hits the road. Needs are the things that keep a roof over your head, food on the table, and basic services running. I use a checklist to make sure I’m not missing anything important.

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Insurance (health, car, etc.)

- Transportation (car payment, gas, or public transit)

- Minimum payments (credit cards, student loans)

Step 3: List Your Wants

This part is all about balance. Wants bring joy and flexibility to your life, but they’re not necessary for survival.

Consider:

- Dining out or coffee shops

- Movies, concerts, or events

- Subscriptions (Netflix, Spotify, gaming)

- Travel or weekend trips

- Shopping for clothes, electronics, or home items

- Gym memberships or hobbies

If you’re ever unsure what counts as a want, ask yourself: Could I pause or skip this expense for a month without serious harm? If yes, it’s probably a want.

Step 4: Allocate to Savings & Debt

This chunk goes directly into building up savings or attacking debt.

- Emergency Fund: Aim to save for 36 months’ worth of living expenses, even if you start small.

- Retirement (401k, Roth IRA, etc.): Slow and steady wins here; regular contributions can really pay off down the road.

- Debt Repayment: Focus extra funds on high-interest debt (like credit cards) for the biggest relief.

- Investments: Once your basics are covered, start putting some money into investments that fit your long-term financial vision.

Tools & Templates to Make It Easy

Digital tools keep money stuff organized. Here are a few easy ways to track your budget:

- Google Sheets or Excel: Both are free and flexible. Grab a monthly budget template that fits the 50/30/20 rule or build your own from scratch.

- Notion Budget Templates: Notion lets you track categories and see your progress over time. Browse their template gallery for “50/30/20 budget” and pick one that feels simple.

- Budget Apps: Mint or EveryDollar automatically track and sort spending into buckets, which is great if you prefer something hands-off.

If you want a quick starter, here’s a text version you can copy and use:

Net Income: $____

Needs (50%): $____

Wants (30%): $____

Savings/Debt (20%): $____

Just fill in the numbers every month and track your progress over time!

How to Adjust If You Can’t Fit the 50/30/20 Rule Exactly

Real life rarely lines up with perfect percentages. If your rent or bills take up more than 50% of your income (which is common in high-cost cities), here’s what you can do:

- Tweak the Percentages: If needs cost more, see if you can trim wants for now or increase your savings rate once circumstances shift.

- Boost Income: A side hustle or part-time gig—even picking up extra shifts—can help fill in the gap.

- Cut Back Where Possible: Routinely check subscriptions, online shopping, and optional expenses. You might track down a few you can cancel or pause.

- Automate What You Can: Rather than percentages, try setting fixed mini savings targets until your needs shrink or income grows.

Balance is the goal. Progress in the right direction matters most—it’s not about being perfect every month.

Common Mistakes to Avoid

While using the 50/30/20 rule budget, these snags can creep in. If you know what to watch for, it’s a lot easier to sidestep them:

- Labeling Wants as Needs: Subscriptions, upgraded phone plans, or frequent takeout often feel essential, but usually aren’t.

- Forgetting Debt Payments: Counting only minimum payments as needs works, but skipping extra payoffs in your 20% slows your path to freedom.

- Not Tracking Actual Spending: Even with a great plan, little impulse costs can drain your budget—unless you’re checking in each week.

A quick weekly check-in (just 10–15 minutes) can save loads of stress later on.

Monthly Review Checklist

Before closing out the month, I run through this checklist to see where things went right or veered off course. Here’s what to ask yourself:

- Did I stick close to the 50/30/20 allocations?

- Did my spending match my budget plan, especially for wants?

- How much did I save or pay toward debt?

- If things didn’t match up, what can I adjust for next month?

- Were there any surprises or major expenses coming up that I missed?

This small review keeps you moving forward, month after month, without stressing about imperfection.

Benefits of Using the 50/30/20 Rule

I’ve tried all sorts of budgeting methods, but the 50/30/20 rule genuinely makes budgeting less overwhelming. It helps you prioritize essentials, leaves room for enjoyment, and ensures real savings that build a safety net. Over time, it becomes a skill that gets easier—and maybe even a little fun—once you see the results snowballing every month.

If you’re new to budgeting, don’t worry if it feels clunky at first. Like any skill, practice brings more confidence and peace of mind around your money. Give it a few months, keep track, and allow yourself to fine-tune your plan along the way.

Ready for the Next Step? (Boost Your Income, Too)

If you want to do more than just get your monthly budget template in place—maybe you’re eager to boost your income—I recommend checking out affiliate marketing as a side hustle.

There’s a training program that’s perfect for beginners. It’s actionable, self-paced, and walks you through how to earn money online without scams. You’ll get advice on finding a niche, building an audience, and making your first sales, all backed by a supportive community.

➡️ Ready to level up your earning potential and stick with smart budget habits? Check out this beginner-friendly affiliate marketing training and start strengthening your online income foundation today!