Ever reach the end of the month and wonder where your money went? I’ve certainly been there, checking my bank account only to realize I can’t even remember half of what I spent my cash on.

When income isn’t tracked intentionally, those sneaky little purchases tend to add up fast.

The trick I’ve found really helpful?

Giving every dollar a job by using a zero-based budget.

No more mystery expenses, no more oversight.

If you stick with me here, you’ll have everything you need to set up a zero-based budget from scratch and actually track it properly, step by step.

What Is a Zero-Based Budget?

A zero-based budget is as straightforward as it sounds: your total income minus your total expenses equals zero.

If you’re picturing a balance that sits at R0 by month’s end, you’re spot on, but that doesn’t mean you’re burning through every cent.

It just means you’ve assigned every dollar to a job, whether that’s groceries, rent, savings, or even your Friday night takeout.

Nothing is left floating around, unplanned.

This is different from a traditional budget, where you might just set broad monthly spending limits and hope things work out. With zero-based budgeting, intention is everything. You don’t just hope; you know exactly where your money is going.

Recommended Reading: How To Build A Monthly Budget Using The 50/30/20 Rule – Step By Step Guide

Why Zero-Based Budgeting Works So Well

Zero-based budgeting isn’t just a neat financial trick; it’s really effective for several reasons.

You get super aware of your spending habits because every category gets a set amount. There’s nowhere for “invisible” expenses to hide, so those random splurges stick out fast.

If you often feel that your money controls you more than you control it, this method gives you back that control. It’s also pretty handy if your income isn’t always the same each month, like if you freelance, have side gigs, or run your own business.

You can adjust your spending every month according to what you actually earn, rather than just guessing.

How to Create a Zero Based Budget (Step by Step)

Getting a zero-based budget up and running isn’t complicated, but it does take some honesty with yourself.

I’ll break down the main steps I always follow:

Step 1: Calculate Your Monthly Net Income

This includes whatever’s left from your paycheck after tax, pension, and deductions. If you do side work or sell stuff online, add that in too. Stick to actual take home money—no need to include gross income.

Step 2: List Fixed Expenses

Fixed expenses happen every month for the same amount, like rent, insurance, loan repayments, cellphone contracts, and your Netflix subscription. Go through bank statements to check what really goes out each month and write down the exact numbers. Guessing here usually ends in frustration.

Step 3: List Variable Expenses

This is everything that can swing up or down: groceries, fuel, eating out, personal shopping, and entertainment.

Pull up your bank app or online statements for the past few months. Average out what you spend in these categories instead of just picking a number from thin air.

Step 4: Assign Every Dollar a Job

This is where things get interesting. You’ll assign what’s left to savings (like that rainy day fund), debt repayment, extra treats, or literally any other category you need.

Once every rand is spoken for, whether it’s going to the emergency fund or towards that birthday present coming up, your income minus expenses will be zero. If it’s not, adjust the categories until you’ve allocated everything.

Dig Into the Psychology of Money Management

Before we move any further, it helps a lot to think about your relationship with money.

Most of us grow up with certain beliefs around spending and saving—even about what it means to be “good” or “bad” with cash.

For instance, maybe you remember your parents always worrying about bills, or perhaps you were told that splitting every cent is the only way to get ahead. These ideas shape our habits now.

Take a bit of time to mull over your own money mindset. Do you try to avoid checking your balances because you’re nervous about what you’ll find?

Maybe you reward yourself with small treats after a tough week, not realizing how quickly those top up. The point isn’t to judge, just to get a sense of where your attitudes come from.

Once you know what drives your spending, building a zero-based budget becomes a whole lot easier—and sticking with it feels less like punishment and more like a way to actually look after yourself.

How to Track a Zero-Based Budget Effectively

Just making a neat plan isn’t enough.

Actually tracking what you spend is the part where most people (including myself, at first) lose steam.

I recommend choosing a rhythm that matches your life. If you have lots of small purchases, daily tracking is really helpful. Otherwise, a weekly check-in could work.

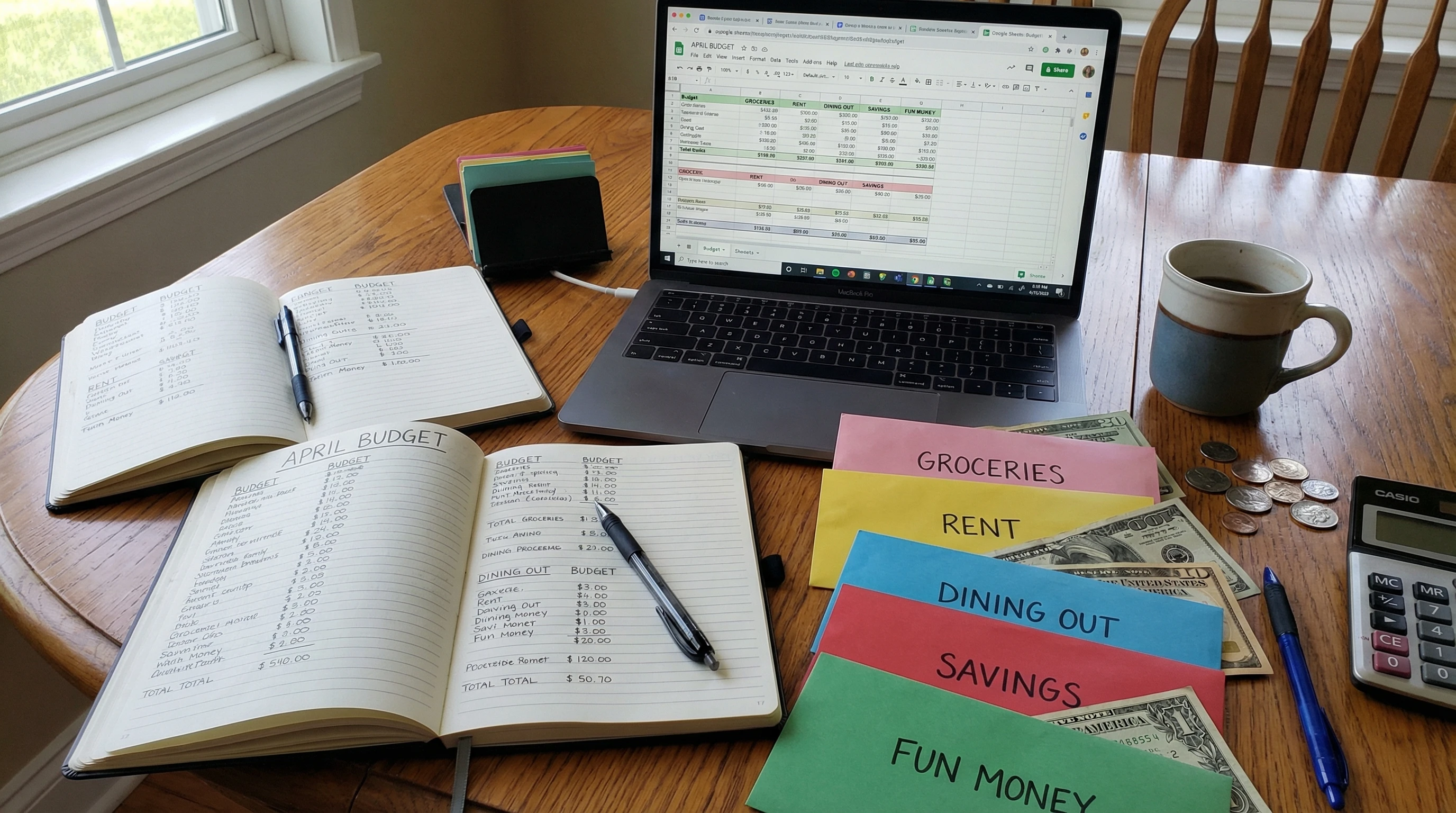

Manual tracking (using pen and paper or a spreadsheet) forces you to pay attention, but honestly, budgeting apps make the process smoother if you’re a techie.

Apps even categorize your spending automatically, which is pretty satisfying once you get rolling. The main thing is to catch slips early, so you can adjust before things get out of hand. Tracking is about self-awareness, not about being perfect.

Example of a Zero Based Budget

Here’s a simplified monthly budget so you can see what it looks like in practice:

Amount Salary (net)R15,000

Side IncomeR2,000

Total IncomeR17,000

RentR6,000

GroceriesR2,200

TransportR1,000

UtilitiesR800

Phone/Internet R600

Insurance R900

Eating Out R400

Savings R2,500

Debt Repayment R1,400

Entertainment R400

Personal/Other R800

Total ExpensesR17,000

Notice every single rand is accounted for. Nothing left on standby, just waiting to disappear.

Tools to Help You Track Your Budget

There’s no wrong way to track your budget, only ways that fit your style. Here are some options I’ve used over the years:

- Spreadsheets: A simple Google Sheet or Excel file lets you list all your categories, track income and expenses, and get a running total.

- Budgeting Apps: There are a bunch (like 22seven, Goodbudget, or YNAB). These can send notifications, autocategorize spending, and give easy built-in reports.

- Envelope System: Use actual envelopes for each category if you prefer handling cash, or use a digital version for card payments. Once a “virtual envelope” is empty, that’s it until next month.

Common Mistakes to Avoid

I’ve learned a few hard lessons doing this myself.

Here are the most common stumbles and how to dodge them:

- Forgetting Irregular Expenses: Things like car servicing, medical checkups, or yearly insurance premiums are easy to overlook. Split these into a monthly amount and set aside cash so you’re ready when the bill arrives.

- Being Too Strict: Cutting every little joy or not leaving space for a coffee can backfire, making you want to give up. Keep a “fun” or “flex” category to breathe a little.

- Not Updating Mid Month: A budget that only exists on the first of the month is usually out of date soon after. Check in and switch things around if something unexpected comes up instead of ignoring reality.

- Giving Up After One Bad Month: Everyone messes up at some point. Treat it as a learning curve, not a fail. Real progress comes with practice, not perfection.

How to Adjust Your Zero-Based Budget Month to Month

Life changes, and so will your spending (and sometimes your income, too).

When this happens, it’s totally fine to shuffle your categories.

Earned extra doing overtime or through a side hustle?

Assign those extra rands before they become accidental spending money. If expenses go up (like if your water bill spikes in summer), see where else you can trim. The big takeaway: budgets survive if they evolve along with your reality, and yours absolutely should.

Who Should Use Zero Based Budgeting?

I’ve seen this approach work for loads of different situations, including:

- Newbies who get anxious not knowing where money’s going or who want a straightforward system

- Anyone aggressively saving for a big goal (like a trip, car, or deposit)

- Folks are trying to pay down debt faster, since you can intentionally throw extra at those repayments

- Entrepreneurs, freelancers, and side hustlers with incomes that go up and down

Extra Tips: Building Habits for Consistent Results

If sticking with a zero based budget feels tough at first, try setting up little routines to keep you on track.

Make it part of your Monday morning ritual to review your expenses, or schedule a quick check-in every payday to see where things stand. Find an accountability buddy who wants to build better financial habits, too, so you can encourage each other if one of you starts to slide.

If you get really into it, you might even start tracking small wins—like how much extra you sent to savings in a tough month compared to before.

Over time, these micro wins help build the confidence that this isn’t just “another spreadsheet”—it’s a set of habits that let you take control of your future, one budget at a time.

Wrapping Up

Zero based budgeting isn’t about pinching pennies or feeling deprived; it’s about finally being in the driver’s seat with your cash flow.

Once you’ve got the hang of it, making financial decisions and handling surprises gets smoother because you know exactly what you can afford.

You’ll start building momentum, and that makes every future money goal feel a little less far fetched. Over months, this momentum grows, giving you clarity about priorities—not just today, but as your financial world changes. Stick with it, keep tweaking, and soon, your budget becomes second nature.

Ready to Boost Your Income? Beginner Friendly Affiliate Marketing Training

Learning to manage money is a massive win, but growing it is a game changer. If you’re looking for a simple way to bring in extra income without the scammy stuff, affiliate marketing is worth checking out.

This beginner friendly training is flexible, step by step, comes with a supportive community, and ditches all the annoying recruiting or MLM traps. You’ll get the skills to slowly build a real online income, just like building up your savings from scratch.

👉 If you’re serious about your financial goals and want to add a legit side income to your budgeting game, here’s a training that fits right in with your zero-based game plan.