Credit card debt is one of the easiest traps to fall into, and honestly, it can sneak up on you pretty fast. The combination of high interest, minimum payments that never seem to make a dent, and balances that creep up even when you’re trying your best—it can be enough to keep anyone awake at night.

If you feel overwhelmed or even embarrassed by it, you’re definitely not the only one.

This guide breaks down how to manage credit card debt in a clear, step-by-step way. I’ll walk you through what makes this kind of debt tricky, how to lay everything out in black and white, how to put a real plan in place, and share a few tips that helped me when I felt stuck.

Whether you’re just starting to look for answers or you’ve tried a few things that didn’t work, these steps can get you moving in the right direction.

Why Credit Card Debt Feels So Tough to Get Out Of

Credit cards offer what’s called “revolving credit.”

This means as long as you’re making payments, you keep getting more access to spend up to your limit. Instead of a set monthly payment to knock out a loan, cards drag balances on and on.

Here’s the sneaky bit: Minimum payments are set low enough that the interest keeps piling up in the background.

Most cards have interest rates much higher than student loans or car loans, sometimes reaching 18%, 22%, or even higher.

Paying only the minimum almost guarantees you’ll be stuck paying for years, with lots of your money going straight to interest instead of principal.

Even if you’re making payments every month, your balance doesn’t drop as quickly as you’d expect. New fees, interest piling up, or even just a couple of new charges can undo your progress. This is why credit card debt tends to feel like it’s never really shrinking.

Credit card companies also benefit from the fact that spending with a card feels easier than using cash.

That feeling of a limitless wallet can be tough to resist, especially in emergencies or during the holidays.

Building an awareness of how often you use your cards can help you spot the patterns that lead to rising balances.

Recommended Reading: Struggling With Debt? These Are The Best Budgeting Apps To Use

Step 1: Get Super Clear About What You Owe

Managing credit card debt starts with knowing exactly where you stand, even if facing the numbers feels overwhelming.

Grab a pen, open a spreadsheet, or use notes on your phone to make a list:

- Card name (e.g., Visa, Mastercard, store card)

- Balance

- Interest rate (APR)

- Minimum monthly payment

Having a full list saves you from guessing. A clear picture of what you owe is the first step in gaining control and making real progress.

If you have more than three cards or you use different apps or online accounts, consider printing out your statements or gathering screenshots for one big review session.

This makes it easy to check everything at a glance and keep each detail accurate. Double-check your recent statements for any surprise charges, pending transactions, or fees—sometimes little mistakes or unauthorized charges can slip through.

Step 2: Stop Adding to Your Balance

Before you even worry about repayment, pause any new credit card spending if you can.

This might mean leaving your cards at home, freezing them in your banking app, or even stashing them in a drawer for a while.

Pausing extra purchases stops your balance from climbing and makes every payment you send in actually matter.

This isn’t about never using a credit card again.

It’s just about not digging a deeper hole while you’re focused on getting out. If you’re inclined to reach for your card for emergencies, consider starting a small emergency fund, even if it’s just $200 set aside in a basic savings account. Relying less on credit creates breathing room for your plan to work.

Changing day-to-day habits is just as important as picking the right debt repayment method. Swapping out card spending for cash or debit, waiting 24 hours before making any purchase, or even setting reminders on your phone can help break the cycle.

If you’re shopping online, take a pause before entering your card details. Sometimes, giving yourself even an hour to reconsider a purchase can save you from spending you’ll regret later.

Consider using a simple list of “needs” and “wants” and strict rules for only using credit on true needs. Remember, making small routine changes day to day really adds up over time.

Step 3: Pick a Debt Repayment Plan That Fits You

There are a couple of popular ways to pay down multiple credit cards. Choosing the one that clicks for you helps you stick with it long enough to see big results.

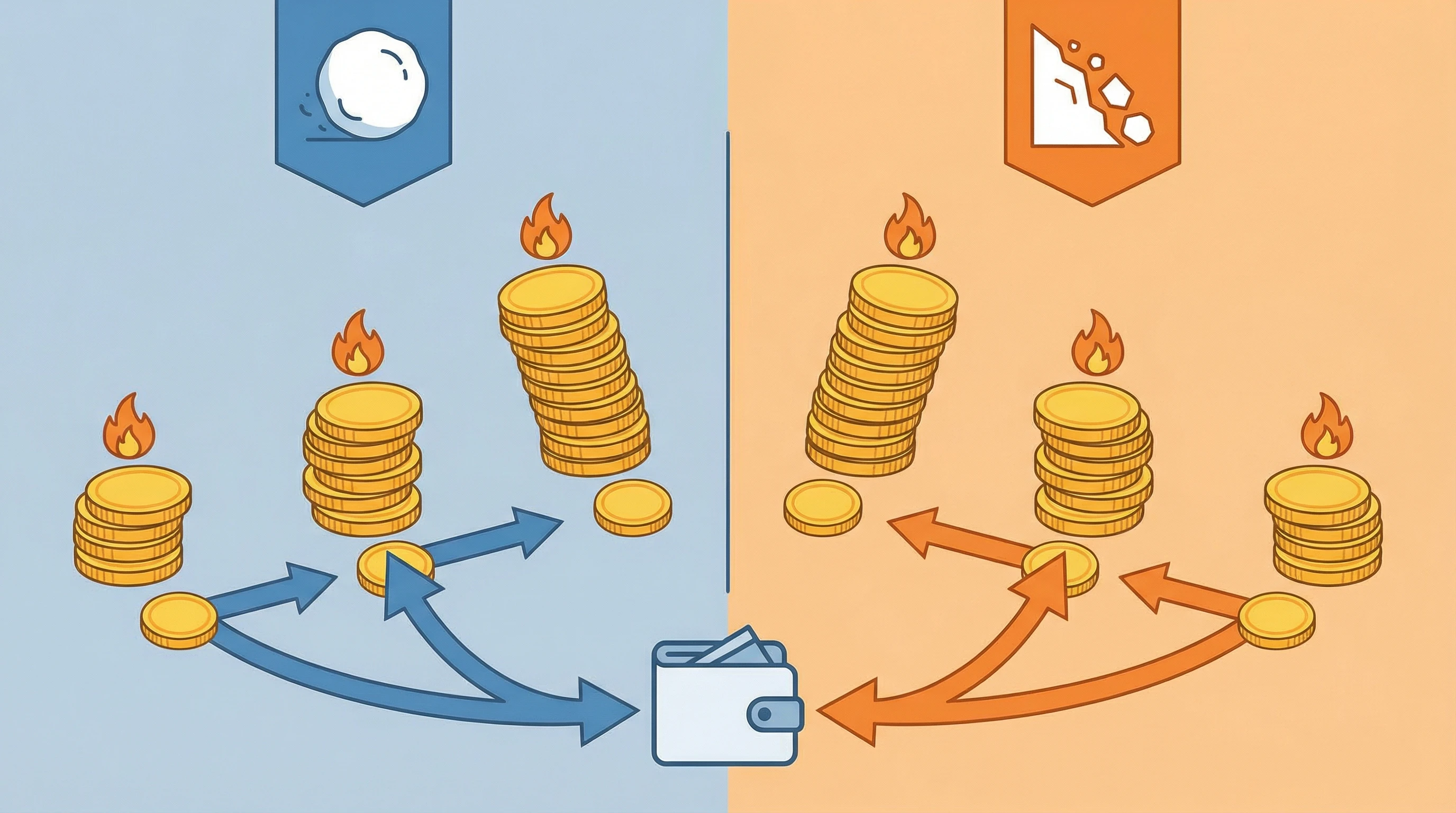

Debt Snowball Method

The debt snowball is all about quick wins.

You start by paying off your smallest balance first while making minimums on the others. When that card hits zero, you move to the next smallest, adding what you were paying before onto that one.

With every card paid off, the amount you put toward the next one gets bigger, like a snowball rolling downhill.

This method is great for keeping up motivation because you see results faster. Seeing a card actually hit zero is a big deal and can keep you moving even when it gets tough.

If you respond well to clear progress and like ticking items off a list, the snowball is a good match. It doesn’t always save the most in interest, but the boost you get from small victories can keep you going for the long haul.

Debt Avalanche Method

The debt avalanche focuses on the numbers.

You put all your extra cash toward the card with the highest interest rate, while paying minimums on the rest.

When that one’s gone, you move to the next highest interest card. This saves you the most money in the long run since your high-interest debt gets knocked out first.

If you like seeing numbers work out in your favor and want to pay the least amount in interest, this method works well.

It can sometimes take a bit longer to clear that first card, but the savings can really add up. People who enjoy a logical approach or want to cut costs as much as possible tend to like this option more.

Balance Transfer Offers

Some cards let you transfer a balance to pay zero interest for a period (usually 6 to 18 months). If you have good credit and qualify for an offer like this, it can buy time to pay off the balance faster, since all your payments go to the debt instead of paying interest.

Watch out for transfer fees, which are usually around 3 to 5% of the balance, and make sure you can pay it off within the introductory period.

If you don’t, the new card’s interest kicks in and you’re right back where you started, sometimes with even more debt.

Always read the terms of the new card before jumping in—sometimes a low promotional interest rate only applies to balance transfers and not to new purchases.

Step 4: Budget for Real Progress

Budgeting doesn’t have to be complicated or restrictive.

It’s just about making sure your spending matches your goals. Break your monthly income into fixed expenses (rent, bills), variable expenses (groceries, gas), and fun spending (coffee, streaming).

Look for spots where, even a little, you can switch money toward debt—like skipping a takeout meal or holding off on a new subscription. Every extra dollar you put toward cards means a faster path to freedom.

Apps like You Need a Budget (YNAB), Mint, or Goodbudget can be really helpful, but a basic spreadsheet or even notepad works if you prefer to keep it simple. The trick is to actually track, not just guess.

Set aside 15 minutes once a week to update your totals and see how you’re tracking. The more you keep your plan close at hand, the better your results.

Don’t forget to build small rewards into your plan.

Saving $20 on lunch? Maybe put $2 toward a little treat and $18 toward your debt. Budgeting works best when it doesn’t feel like endless sacrifice.

Balancing discipline and small rewards keeps motivation high and makes it easier to stick to the plan.

Step 5: Lower the Cost of Debt (Interest and Fees)

Even a small drop in your interest can make a big difference.

Some card companies will reduce your rate if you’ve been a customer for years and hit a rough patch. Give customer service a call, be polite, and see if they’ll work with you. It doesn’t always work, but it’s worth asking. Even a 2% reduction can add up to hundreds saved over a year.

Avoiding late fees is another way to save real money. Setting up automatic payments for the minimum or more means you never risk missing a date because life got hectic. Even switching your due dates to the day after payday can reduce mistakes.

Check your statements for other hidden fees or penalty APRs that might have been triggered by missed payments. If you find any, calling your issuer and showing that you’re back on track can sometimes get fees reversed. More of your hard-earned money should go toward principal, not penalty fees.

Step 6: Give Your Payoff Power a Boost

The fastest way to crush debt is attacking it from both sides: spend less and earn more.

Cutting back on extras in your budget definitely helps, but finding ways to bring in extra money—like picking up weekend gigs, freelance work, or selling things you don’t need—brings results even faster.

This doesn’t mean working yourself to exhaustion. Small boosts in income, when put entirely toward your debt, can speed up your progress by months or even years. Just knowing you have more options than just cutting back can make you feel lifted up.

Brainstorm your marketable skills—maybe you’re great at writing, tutoring, organizing, or even pet sitting. Explore short-term gigs on platforms like TaskRabbit, Upwork, or Fiverr, or look for local opportunities in your area. Direct every bit of extra earnings into debt payments and celebrate each milestone as you shrink your balances.

Common Mistakes That Make Debt Harder to Beat

- Paying only the minimum: It keeps you stuck paying interest for ages.

- Closing cards too early: Can hurt your credit score and limit your options.

- Ignoring statements: New fees or interest hikes can pop up if you don’t check regularly.

- Chasing “quick fix” solutions: Most debt shortcuts aren’t real and can cost you more money.

- Using new credit to pay off old debt: This usually just moves the problem around instead of solving it.

One more mistake?

,Not tracking your emotional triggers. If you tend to overspend when stressed or tired, build healthier routines like walks, talking to friends, or even journaling, so you’re less likely to spend impulsively.

How Long Before You’re Debt-Free?

The time it takes depends on your balance, the rates, and how much beyond the minimum you can pay.

As a rough idea, if you owe $3,000 at 20% interest and only pay the $90 minimum, it could take close to 15 years and around $4,000 just in interest. Kick up the monthly payment to $200, and you’re done in less than two years, with a whole lot less paid in interest.

Consistency is really important here. It’s not about making perfect payments every month. It’s about making steady, regular progress—even if it’s slow at first.

Every bit helps. Whenever you get a cash windfall, such as a tax refund, birthday money, or a bonus at work, aim to put at least a portion of it toward knocking down your balances.

Watching the total get smaller can be the morale boost you need to stick with your plan.

Is DIY Debt Management Better Than Consolidation or Counseling?

Self-managing your debt (using snowball or avalanche methods) puts you in the driver’s seat, letting you control your payments and methods.

Debt consolidation—a bigger loan to pay off all cards at once—can make things easier and sometimes lower your interest, but only if you don’t rack up new balances.

Debt counseling or working with a credit counseling agency is another path, and can help people who feel totally overwhelmed by the details.

Debt consolidation is worth checking out if you have solid credit and a realistic plan to avoid racking up new balances. If you’re not sure, or if you’re dealing with collections or missed payments, a conversation with a credit counselor can open up more options and help you avoid mistakes that might hurt your credit.

Credit counseling agencies can also help you make a debt management plan, sometimes getting creditors to agree to lower interest rates.

Make sure to check for any fees, and always research a counseling service before signing up.

Bigger Picture: Earning More Makes Debt Payoff Way Easier

Tracking your budget and controlling spending is a great step. But making more money—through new skills, freelancing, or even starting a small online business—gives your plan some real rocket fuel.

If you’re interested in learning how to build background income, I recommend checking out a solid online business training community that not only walks you through step-by-step skills but also helps build something sustainable for the long term.

This kind of steady skill-based income is what really helped me finally escape the debt cycle for good. Building multiple income streams not only helps you pay off the balances, but it also offers more financial freedom once your debt is gone.

Think about picking up skills that are in demand online, like design, writing, or consulting, and tap into marketplaces where you can get paid for your talents. If you’re curious about plugging into the platform I use, you can check it out right here:

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

Frequently Asked Questions

How bad is credit card debt for my credit score?

Your score usually takes a hit when you’re close to your credit limits or if you miss payments. The more you pay down your balances—and pay on time—the better your chances of improving your credit over the long run.

Should I close paid-off credit cards?

It’s usually better to keep older cards open, as closing them can shrink your available credit and lower your credit score. Keep the card open, but put it away so you’re not tempted.

How can I avoid getting back into debt in the future?

Building an emergency fund, living within your budget, and only using cards for things you can pay off right away are habits that really help. Over time, these habits can make credit card debt less stressful and even give you some helpful perks from your cards without the worry.

Tackling credit card debt might feel overwhelming, but breaking it down into small, consistent steps makes it a lot more manageable.

With a good plan, some behavior tweaks, and maybe a nudge in your income, you’ll see progress. That little burst of relief when a card balance finally hits zero?

Feels fantastic. You’re definitely not alone, and it’s possible to get through it.

Wishing you everything of the best

Regards

Roopesh