Sticking to financial goals isn’t just about setting a budget once or writing out some numbers on a sheet of paper.

A lot of people want to save more, pay down debt, or start investing, but only a handful manage to actually keep going when things get tricky.

Motivation to save or cut back usually feels high at the beginning. But once real life gets in the way, those good intentions often get pushed aside.

Why Financial Goals Often Fade Out

Most people aiming to reach their money goals run into the same hurdles.

Having super high expectations, skipping a detailed plan, or letting emotions take control during shopping sprees can all trip you up.

I’ve been there myself, telling myself I’d “just spend less” or “stick to this budget,” worked for a week until a stressful day or a killer sale hit.

- Unrealistic expectations: It’s easy to overestimate what you can save or pay off in a short time. If it feels too ambitious, odds are it’ll be tough to stick with.

- No clear planning: Goals written as “save more” usually fizzle out, while specific steps and numbers make it easier to follow through.

- Emotional spending: When emotions are high, whether it’s excitement or stress, the urge to treat yourself often leads to breaking your own rules.

- Lack of accountability: Without anyone to check in with or help track progress, it’s easy to forget or ignore your goals.

9 Smart Habits of Financially Successful People

Consistency makes the difference here.

I’ve pulled together these habits after years of helping others (and myself) stay on track.

Here’s how financially successful people keep their eyes on the prize, even when roadblocks pop up.

If you’re looking to jumpstart your own adventure toward money confidence, these are solid places to begin.

Let’s check out each one in greater depth.

1. Define Clear and Specific Financial Goals

Super vague targets like “I want to save money” don’t really work. A goal needs some structure.

One simple framework that’s pretty handy is SMART.

Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound.

So instead of “pay off debt,” I’d write, “Pay off $2,000 in credit card debt by December 2024.” Or “Save $100 every month for a new laptop starting in March.”

Getting specific turns plans from big dreams into practical targets. Some examples I’ve used or suggested:

- Cut $5,000 off my student loan balance this year

- Save $1,500 for a vacation by August

- Invest $200 a month into my retirement fund

- Set aside $50 a week in a sinking fund for holiday gifts

2. Break Big Goals Into Small Achievable Milestones

Longterm goals can feel way out of reach, so breaking them into smaller pieces keeps the pressure off and helps build momentum.

Instead of focusing on the total amount you want to save for retirement, decide how much you’ll set aside every month or each paycheck. I like to use checklists or even simple progress trackers.

There’s something really satisfying about knocking off a smaller target or watching a bar fill up over time.

- Monthly vs yearly targets: Focus on what you can do this month, not just the end-of-year amount.

- Visual progress tracking: Apps or oldschool charts can help you see just how far you’ve come, and that bit of progress is motivating.

- Set milestone mini-rewards: Promise yourself a small treat after every $500 saved or debt paid

3. Automate Your Savings and Investments

Once I set up automatic transfers for savings and investments, my progress shot up.

When savings happen without thinking about it, there’s less temptation to spend. This “pay yourself first” approach means you treat saving like a required bill, not something you maybe get around to later.

Most banks and investment accounts let you set up regular automatic transfers for free.

- No more decision fatigue; savings just happen without effort.

- Helps avoid missed months due to forgetfulness or emotional spending.

- Can set up separate accounts for different goals, making it easier to track.

4. Track Your Spending and Financial Progress Weekly

It’s easy to let small purchases pile up and then wonder where all the money went at the end of the month.

I set aside a few minutes each Sunday to check up on my spending and if I’m on track. Whether you use a spreadsheet, notebook, or budgeting app, getting into the habit of reviewing your money regularly makes you much less likely to overspend without realizing it.

- Catch small problems before they turn into bigger ones.

- Noticing patterns makes it easier to course-correct early on.

- Use color-coding or categories in your tracking for faster insights.

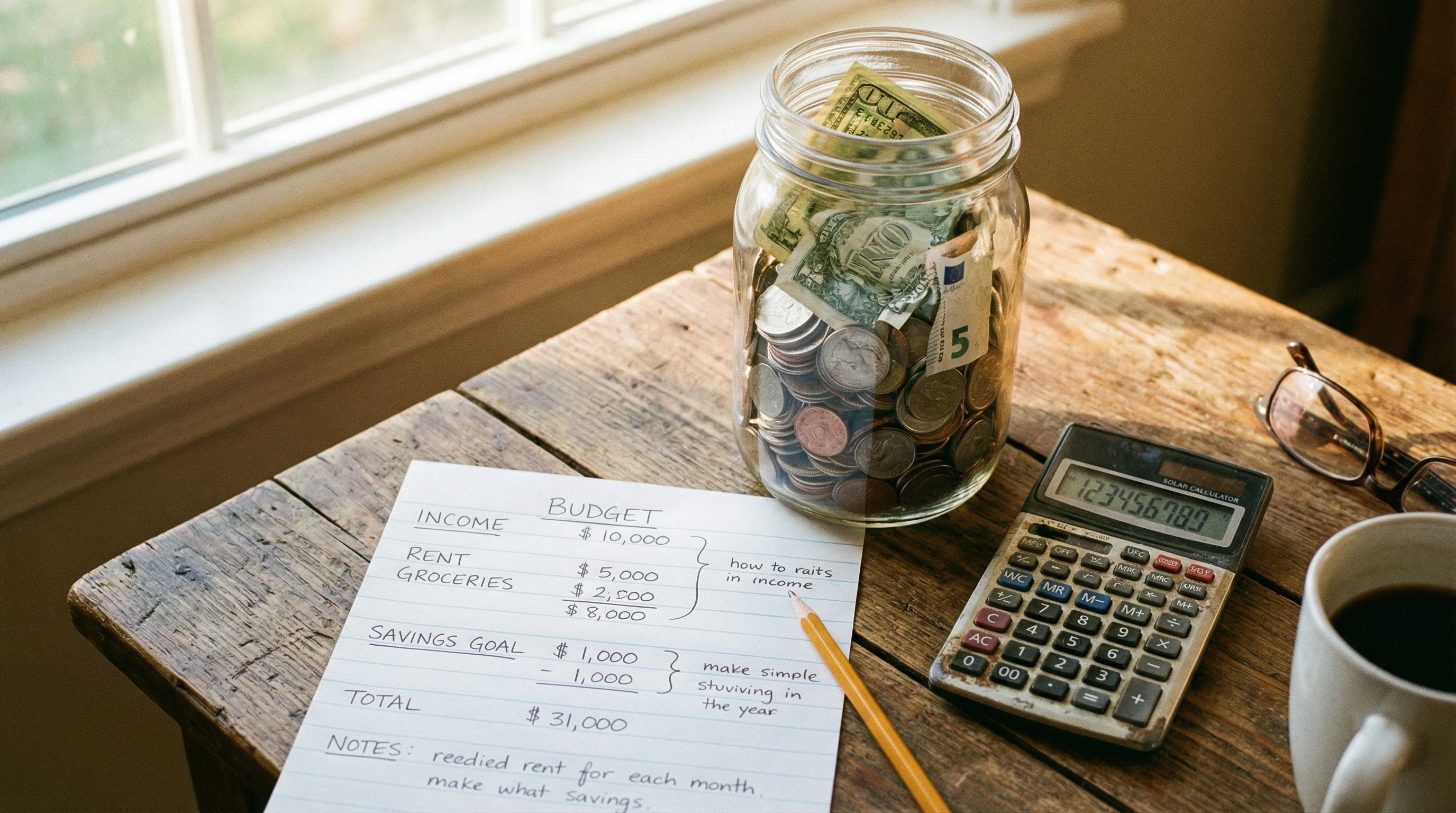

5. Build a Realistic Budget You Can Actually Follow

The best budget is one that fits into your life, not one that feels like punishment. There’s no use setting a super strict plan if it means you always break it and feel bad.

Flexible budgets let you adjust for oneoff expenses or an occasional treat. Adding a line for fun or “guilt-free” spending is super important—it’s not about removing all enjoyment, it’s about making sure everything fits.

- Flexible budgets can be adjusted as life changes.

- Allow room for “fun money.”

- Treat your budget as a helpful guide, not a strict limit.

6. Reduce Emotional and Impulse Spending

Impulse buys are a real trap.

It often happens when I’m tired, stressed, or feeling like I deserve a reward. Recognizing those emotional triggers is a big step forward. I use waiting periods before any non-necessary, purchases.

Sometimes even just sitting on a purchase for 24 hours is enough to lose interest. Some people swap a shopping habit for a walk, texting a friend, or getting into a hobby instead.

- Notice when you tend to spend impulsively (late at night, after work, etc.).

- Try a cool-off period—hold off for 24 hours before hitting “buy.”

- Replace shopping with another activity that feels good but doesn’t hurt your wallet.

7. Create Accountability Systems

When I told friends about my savings goal, I noticed I kept on it longer than when I kept it private.

Finding a money buddy or joining an online accountability group can make a real difference. Some people share their monthly progress online or with a partner. Even a simple check-in or reminder gives you a reason to stay on track.

- Share your goals with someone you trust.

- Check in regularly and celebrate wins together.

- Online tools or communities can create extra accountability.

8. Increase Your Income Alongside Saving

Cutting back is good, but there’s only so much you can save before you hit a wall.

Finding ways to boost income can make your goals way more doable.

I’ve picked up small side gigs, taken freelance work, or sold unused stuff for some extra cash. Even a little extra every month kicks savings into higher gear and feels good.However, not everything went in my favour initially. Check out my full story here.

- Explore freelance work, part-time jobs, or selling unused items around the house.

- Invest time in learning popular, marketable skills to increase earning opportunities.

- Treat income increases as chances to add to your financial plan, not just increase spending.

Check out my number one recommended training platform to start building a long-term online business. Click on the image below to learn more:

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

9. Review and Adjust Your Financial Plan Regularly

Life changes, and so should your financial plans.

Relationships, jobs, and even interests can switch up, and your budget or goals need to change, too.

I like to review everything every month, looking at what worked, what didn’t, and how close I am to my smaller milestones.

Celebrating a win (even a small one) keeps the process positive rather than feeling like endless restriction.

- Mark a monthly money check-in on your calendar.

- Be honest if a goal isn’t working anymore—change it if you need to.

- Enjoy the progress, even the little stuff. Add in a reward system for ongoing motivation.

Common Mistakes That Can Knock You Off Track

- Perfection mindset: Nobody hits their goal every single month. Good money management is about consistency, not perfection.

- Comparing to others: Your life and goals won’t be the same as someone else’s. Focus on your personal progress, not what friends, influencers, or that random millionaire says online.

- Allornothing thinking: Missing a week of tracking or spending a little extra doesn’t wipe out your whole plan. Get back on track and keep moving rather than giving up.

- Ignoring setbacks: Instead of beating yourself up over a slip, figure out what happened, learn from it, and change things up for the future.

- Not adapting: If your financial situation changes, your plan should too. Don’t stick with something simply because it used to work

Recommended Reading: How To Start Investing With A Small Budget

Building Systems That Stick

Longterm financial success comes from building everyday habits and systems, not just riding a burst of motivation now and then.

Financially successful people aren’t born with willpower. They create routines that make good decisions the default.

The mix of automation, regular checkins, and accountability means you move forward, even when you don’t feel like it.

Putting these habits into place turns money management into something you can handle, not something you have to worry about every day.

The Benefits of Small Steps Over Time

It’s pretty eye-catching to see how much these small steps add up over months or years. Just like with fitness or learning a language, it’s the repeated, small effort that wins out.

I’ve seen people pay down thousands in debt, save for big dreams, and build a cushion that totally changes their peace of mind—all from these simple habits. Consistency beats quick fixes every time.

Remember: small, steady steps outshine bursts of effort followed by burnout.

Frequently Asked Questions

Here’s a quick rundown on questions I get a lot when people start working towards their financial goals. If you have your own, feel free to ask someone in your life who’s walked a similar path, or check in with one of many free online communities available for support.

Question: What’s the first thing I should do if I haven’t managed to stick to money goals before?

Answer: Start with one small, specific goal. Make it as clear as possible, like “save $20 a week” or “track all my spending for one month.” Focus just on building the habit, not perfection.

Question: Is it better to focus on cutting costs or earning more?

Answer: Both can help, but you usually need both. Cut out easy expenses, but look for ways to bring in more money for big progress. Over time, mixing both strategies grows your financial security faster.

Question: What if I completely blow my budget one month?

Answer: It happens! Don’t get discouraged. Review what caused it, make adjustments, and get back on track. Success comes from the reset, not from doing it right every time. Everyone has slips—what matters is how you bounce back.

Final Thoughts

Following through on financial goals comes down to more than just good intentions. It’s about turning these smart habits into a regular part of your life. Building systems, tracking progress, and being kind to yourself along the way can take some of the pressure off.

You don’t have to do it all at once, and you don’t need to be perfect. Just keep at it, and those steady habits will get you a lot further than a burst of inspiration.

The key is to stick with small actions and keep moving forward, no matter what bumps show up along the way.

Wishing You Everything of The Best In Achieving Your Financial Goals

Regards and Take Care

Roopesh