Ever read a financial article and feel lost in jargon? APR, compound interest, net worth—it can feel like a foreign language.

The truth is, most of us didn’t get a class in personal finance at school, and all these specialized terms tend to scare people away from taking their money seriously. I get it.

This kind of vocabulary can make anybody feel like they’re in over their head, and that confusion often keeps people from making real changes.

I’ve found that learning some basic terms gives you real confidence with your money. You don’t need an economics degree or a stack of books.

Just knowing the essentials puts the power back in your hands.

That’s why I put together this guide breaking down the 30 most important personal finance terms you’ll come across, explained in plain English. If you’re ready to take control of your money, this is where you start.

Essential Budgeting Terms

Getting your money organized starts with understanding some fundamental budgeting ideas.

Here are the six main terms you really need to know:

- Budget: A budget is simply a plan for how you’ll use your money each month. It helps you see exactly where your money goes, so you’re not left wondering why your paycheck disappears. Having a budget lets you spot spending leaks and keeps you on track with your goals.

- Income: Income is money you earn, and it comes in two main forms: gross income (before taxes and deductions) and net income (your take-home after taxes). Knowing both helps you see how much money you can actually spend or save.

- Expenses: Expenses are all the things you spend money on. Fixed expenses (like rent or car payments) stay about the same monthly, while variable expenses (like groceries or entertainment) change. Keeping track of both helps you spot where you might overspend.

- Cash Flow: This means the movement of money in (your income) and out (your expenses). Positive cash flow means you’re bringing in more than you spend, which is a key marker of financial health.

- Emergency Fund: An emergency fund is money set aside for unexpected situations, such as job loss, car trouble, or medical bills. The standard advice is to have enough to cover 3-6 months’ worth of living expenses. Having this stash can keep you from falling into debt when life throws you a curveball.

- 50/30/20 Rule: This is a simple budgeting guideline: use 50% of your income for needs, 30% for wants, and the remaining 20% for savings or paying off debt. It’s a popular framework for those who want their finances on autopilot without obsessing over every penny.

Recommended Reading: Best Budgeting Courses Online For Beginners (Learn To Manage Money With Confidence)

Understanding Debt and Credit

Debt and credit terms matter because they have a huge impact on your future borrowing options and your capacity to hit big goals.

Here are the most important ones to know:

- Credit Score: This three-digit number (from 300 to 850) shows lenders how trustworthy you are when it comes to borrowing. A higher number means better chances for loan approval and lower interest rates. For example, a score of 780 could unlock rewards cards or mortgage deals you can’t get with a 620.

- APR (Annual Percentage Rate): APR is the cost you pay per year to borrow money, expressed as a percentage. If you’re shopping for a credit card and one offers 18% APR while another is 28%, that rate tells you which one costs you less over time.

- Interest: Interest is basically the fee you pay to borrow cash from somebody else. With simple interest, you pay only on the original loan; compound interest means you pay interest on top of interest, which adds up fast if you’re not paying off your balance.

- Principal: This is the original amount you borrow (say, $10,000 for a car loan). As you pay it off, the interest is calculated off that initial sum.

- Credit Utilization: This is the percentage of your available credit you’re actually using. If you have a $5,000 limit and a $1,000 balance, your utilization is 20%. Most experts recommend staying below 30% to keep your credit score healthy.

- Debt to Income Ratio: This term compares your monthly debt payments to your monthly income. Lenders use it to decide how much more debt you can handle. Lower is always better. For example, if you pay $1,000 toward debts each month, and earn $4,000, your ratio is 25%.

- Debt Snowball: This is a payoff strategy where you tackle your smallest debts first before moving to bigger ones, scoring motivation boosts as you pay each one off.

- Debt Avalanche: Here, you focus on paying off debts with the highest interest rates first, which saves money over time. If you have a credit card at 25% and a car loan at 7%, pay extra on the credit card first.

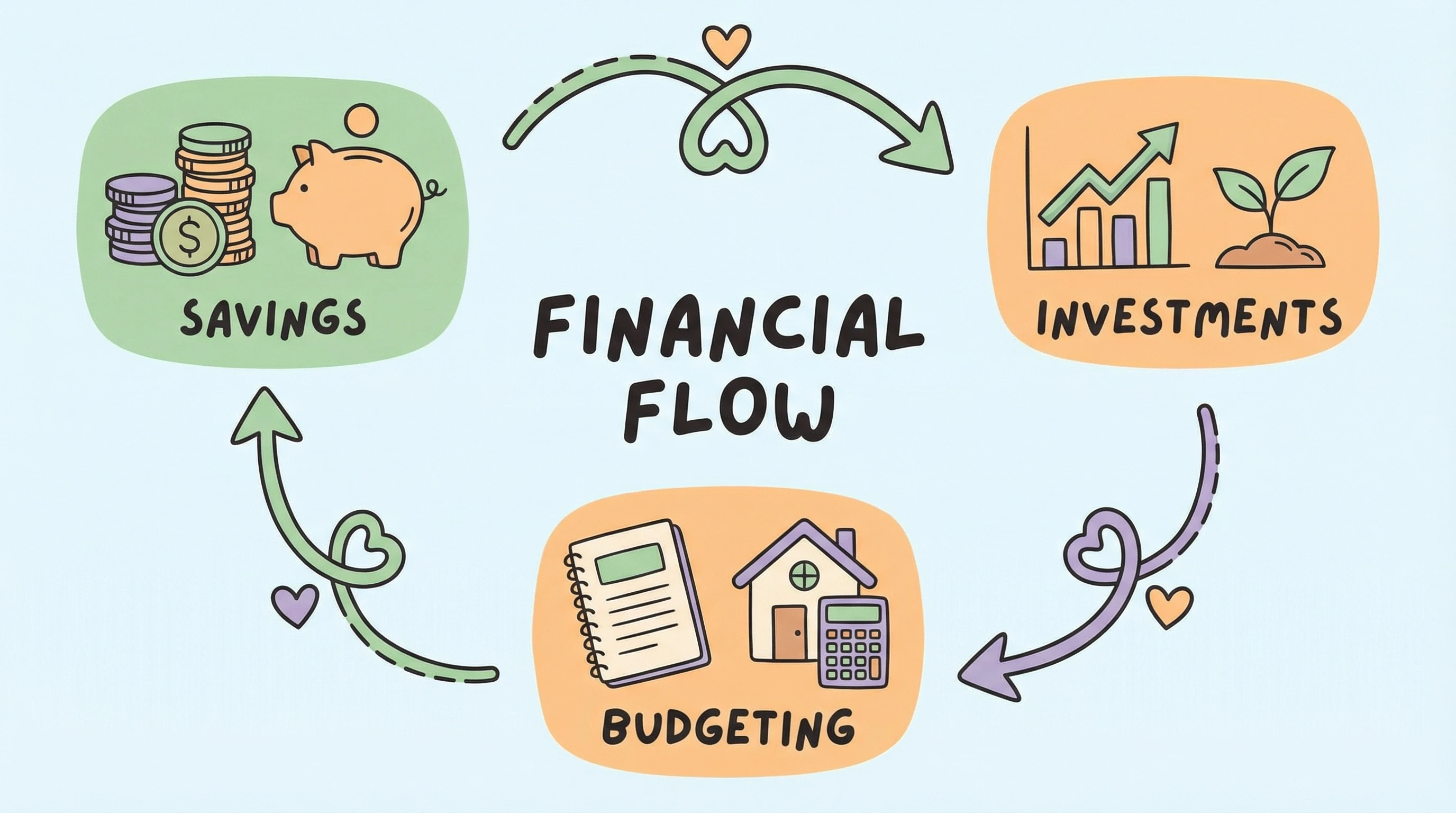

Investment and Savings Terms Explained

Investing and saving are your building blocks for long-term wealth.

Here are the ten terms every beginner should have in their toolkit:

- Savings Account: This is a bank account meant for stashing cash you don’t want to spend right away. Savings accounts keep your money safe, and banks pay you a (usually small) bit of interest.

- High-Yield Savings: These are savings accounts that pay a much better interest rate, often from online banks. A regular savings account might pay 0.1%, but high yield options might pay 4% or more, helping your emergency fund grow faster.

- Investing: Investing is about buying assets (like stocks or bonds) with the hope that they’ll increase in value over time. Your goal is to grow your wealth, and as a beginner, understanding risk is really important. It’s not always a straight upward climb, and losses are possible, but in the long run, the market tends to reward patience.

- Stocks: Stocks represent slices of ownership in a company. When you buy shares, you become a partial owner. Stocks can go up and down in value but tend to offer good long-term returns if you leave them alone and don’t panic in rough markets.

- Bonds: A bond is basically a loan you make to a government or company. They pay you back later, with interest. Bonds are steadier than stocks but usually offer smaller gains, making them a popular choice for people who want stability in their portfolios.

- Index Funds: Index funds pool investors’ money to buy lots of different stocks (or bonds) at once, matching the performance of a market index like the S&P 500. These funds are popular for their low cost and built-in diversification. Beginners often start here because it’s simple and doesn’t require picking individual stocks.

- 401(k): This is a retirement savings plan offered by employers. You can have part of each paycheck automatically sent to a 401k, often with a company match. The money grows tax-deferred until you withdraw it at retirement. Taking full advantage of employer matches is like getting free money, so it’s worth checking if your job offers one.

- IRA: An Individual Retirement Account is a personal retirement account you set up yourself. There are two main types: Traditional (contributions may be tax-deductible, and taxes are paid on withdrawal) and Roth (taxed upfront, but withdrawals are tax-free in retirement). Both give you serious tax advantages that help your money grow faster over many years.

- Compound Interest: Compound interest is when you earn interest on your initial money plus all the interest it’s already made. It can supercharge your growth over time. For example, $1,000 earning 5% yearly will turn into over $1,600 in ten years, not just $1,500, because you earn interest on interest.

- Diversification: This is spreading your money across different types of investments, such as stocks, bonds, and real estate, which helps lower risk. If one thing crashes, your whole portfolio doesn’t go down with it. Even beginners benefit by owning index funds or mixing up investments instead of putting everything in one basket.

Key Wealth Building Terms

Growing your wealth is about more than just stashing cash.

Here are six key terms that shape how I think about long-term money:

- Net Worth: This is your assets (everything you own) minus your liabilities (everything you owe). If you own a car worth $8,000 and have $3,000 in student loans, your net worth is $5,000. It’s the best snapshot of your real financial standing and is super important to track over time. Remember, net worth can go up and down. Focus on raising it over the months and years, regardless of day-to-day changes.

- Assets: Assets are anything valuable that you own, like cash, investments, a home, or a car. Building solid assets is a key part of getting financially stronger. Work to grow your asset base and you’ll have more security and more options.

- Liabilities: Liabilities are the flip side—they’re your debts and any other money you owe, such as mortgages, car loans, or credit card balances. Reducing your liabilities directly boosts your net worth. Prioritize paying down high-interest liabilities first so you save money.

- Passive Income: This is money you earn without needing to actively work for every dollar. Examples include rental property income, dividends from stocks, or royalties. Building passive income streams helps you step back from trading time for money, freeing up your life. Even small streams count and grow over time.

- Active Income: Active income is money you make by working for it, like a paycheck or tips. It’s the starting point for most people, and for many, it pays the daily bills. Combine active income with savings and investment habits to start growing your financial base.

- Financial Independence: This is when your passive income is enough to cover your expenses. You’re not stuck working just to survive; you get to choose what you do next with your time. Many people pursue financial independence for the flexibility and security it brings. It may take years, but knowing the term can help you set meaningful long-term goals.

Start Using These Terms Today

You just learned 30 essential personal finance terms that cover everything from budgeting basics to building wealth.

With these concepts in your back pocket, you can finally make sense of those news articles or money podcasts that used to sound so confusing. More importantly, you’re ready to take charge of your own finances.

You don’t have to make overnight changes. Just start by applying these ideas to your own life. Track your net worth (it only takes a spreadsheet or a free app), make sure you’ve got something stashed for emergencies, and seriously consider putting a little bit into savings or investing every month, even if it’s just a few bucks. Small moves build big results over time.

Here’s the kicker: all the knowledge in the world means nothing unless you use it. These terms are tools.

Pick one to act on this week. Maybe you’ll check your credit score or research a high-yield savings account. Either way, you’re pushing your financial future forward.

If you’re hungry for more, the next step is learning the whole system behind what you’ve just read. Most people don’t struggle with definitions; they get stuck because they don’t know how to put it all together.

I recommend you check out my number one recommended online training program to building an online business:

This online program that breaks down exactly how to:

- Create online assets, such as owning your first website

- Use social media to build a following

- Tap into an exciting A.I. training and create content, articles, and unique images in seconds

- Start earning a passive income from experts who live the proof.

This course helped me finally get started with building that second income even whilst I had my full-time job as a pharmacist.. Learn more about it here. (Heads up: this is an affiliate link, and I only share resources I use myself or have looked into carefully.)

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

You’ve got what it takes to take charge of your money. The first move is just putting your new knowledge into action.