Index funds seem to pop up in almost every personal finance conversation these days, and for good reason.

Whether someone is saving for retirement, trying to start investing on a small budget, or just wants an easy way to build wealth, index funds are usually recommended as a practical choice.

Why Index Funds Are Always a Hot Topic in Money Chats

Talk to anyone about growing their money, and index funds almost always come up as an option that’s easy to manage and pretty reliable over the long haul. I see them mentioned in almost every money book, blog, and even by folks who aren’t usually into investing.

What’s so appealing is that you don’t have to be a finance pro to use them; they’re designed to keep things simple, keep costs down, and still let regular people tap into the power of the stock market.

Stocks vs Index Funds vs ETFs: Clearing Up the Confusion

If you’re just getting started, it’s easy to trip up on the differences between stocks, index funds, and ETFs.

So here’s the straightforward take: When you buy a stock, you’re buying a little slice of one company (like Apple or Coca-Cola).

An index fund, on the other hand, is like a giant basket holding hundreds or even thousands of those slices—built to match the performance of a whole chunk of the market, not just one company.

ETFs (exchange traded funds) are pretty similar to index funds but can be traded on the stock exchange just like stocks. Both index funds and ETFs make diversification a lot easier for regular investors.

What You’ll Learn in This Guide

This guide breaks down the basics of how index funds work without any jargon.

I’ll cover what they are, how they’re built, why so many people start here, what the risks are, and what newcomers need to know to get going.

By the end, you’ll have a clear, practical roadmap for how index funds fit into your money adventure.

What Are Index Funds?

Index funds are a type of investment fund that’s designed to mimic the moves of a specific stock market index, like the S&P 500, FTSE/JSE Top 40, or pretty much any market benchmark you can think of.

Rather than trying to pick ‘winning’ stocks or time the market, an index fund simply buys every stock in the index it’s tracking, holding each in amounts that match the index itself.

For example, if an index fund tracks the S&P 500, it aims to own shares in the 500 companies in that index, proportionate to the size of each company in the benchmark.

If Microsoft is 6% of the S&P 500 by value, the index fund will try to hold about 6% of its portfolio in Microsoft.

Recommended Reading: How Does Compound Interest Work For Savings? How Your Savings Grow On Autopilot

Active vs Passive: The Real Difference

Here’s the big deal: actively managed funds hire teams of professionals to guess which stocks will do better, buying and selling things to try to ‘beat the market.’ Index funds skip the guessing game.

They just follow the index, buying and holding, no matter what happens. That’s why people call index funds a form of ‘passive investing.’

How Do Index Funds Work?

When you invest in an index fund, your money gets pooled with cash from everyone else who buys in.

The fund then uses all that cash to purchase the actual stocks (or sometimes bonds) that make up its chosen index.

Because these funds own little bits of lots of different companies, you get instant diversification—even if you’re starting tiny.

Built-In Diversification

Diversification means not putting all your eggs in one basket. With an index fund, you automatically spread your savings across many companies, making you less vulnerable to a single company having a bad year.

For example, a total market index fund might let you own tiny pieces of 3,000+ companies worldwide, even if you only have $50 invested.

How Returns Are Generated

Your returns from an index fund come from two places: the overall growth in market value as the stocks rise, and the dividends companies pay out (which are usually reinvested automatically).

If the index as a whole goes up by 8%, your holding in the index fund should go up by about 8% (minus a small fee).

The Compounding Effect Over Time

Here’s where things get really interesting.

By leaving your investment alone for the long run and reinvesting your dividends, compound growth starts to snowball.

That’s when you earn returns on your original money, plus on all the returns you’ve gotten so far.

With enough time, this effect can seriously boost your gains—even with very small monthly investments. The magic of compounding can turn a modest investment into a substantial nest egg with consistent contributions and patience.

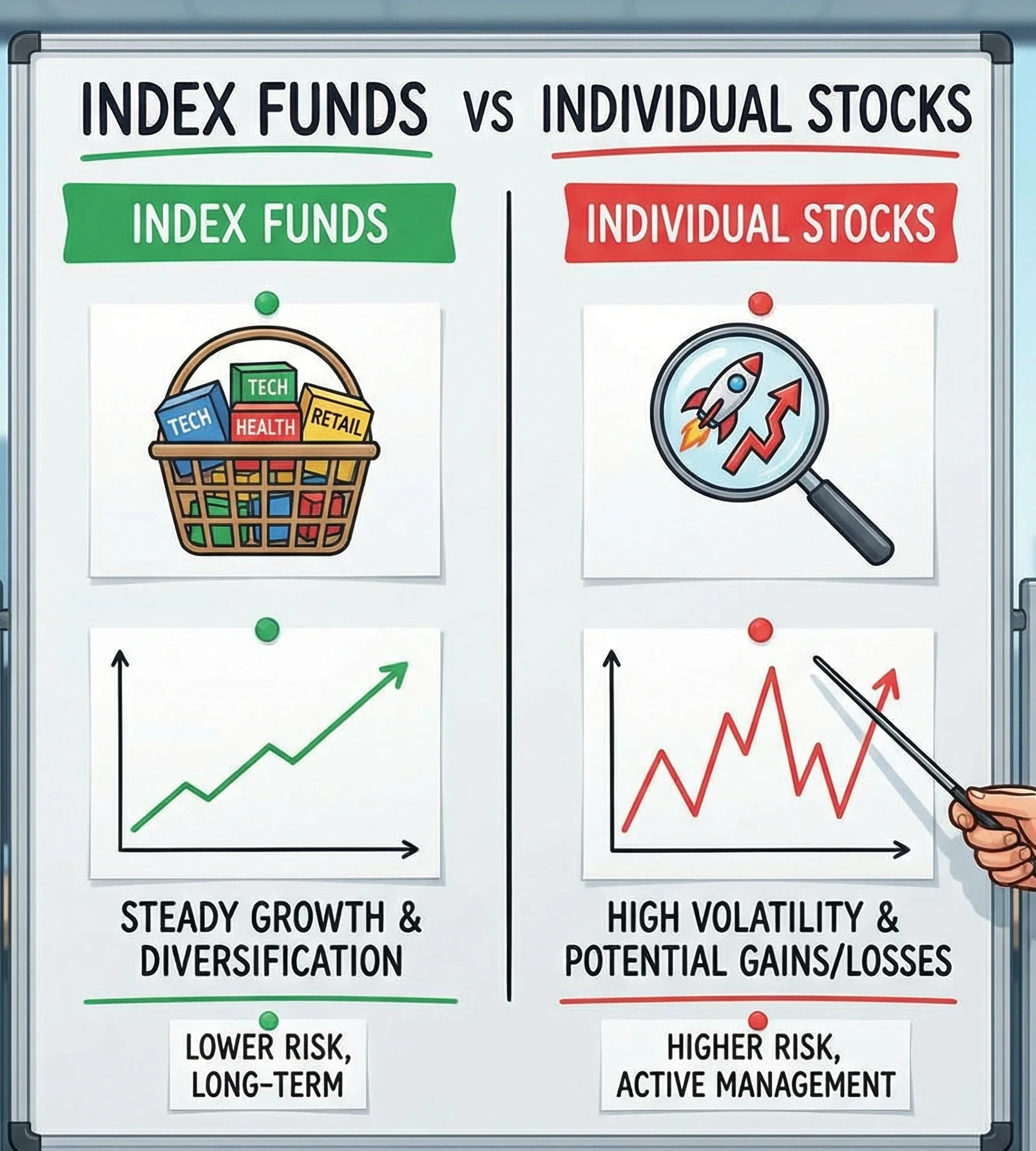

Index Funds vs Individual Stocks

There’s a lot of debate about going all in on individual stocks or taking the index fund approach.

Both have their own flavor, but for most beginners, index funds offer a smoother ride.

- Risk Comparison: Individual stocks can soar, but they can also crash. Index funds soften the blow because you’re owning a little of everything.

- Time and Skill: Picking your own stocks takes research, luck, and way more time than most busy people can give. Index funds keep it hands off.

- Volatility: One bad earnings report can send a stock tumbling. With index funds, even when a few companies struggle, others can balance them out. This creates an environment where your portfolio isn’t at the mercy of just one company’s performance.

Plenty of research points out that most beginners (and even most seasoned pros) do better with index funds than they do trying to outsmart the market. It’s a lot less stressful, too.

Index funds also help newer investors avoid the emotional rollercoaster that comes with chasing trends or trying to time the market. By keeping your approach simple and steady, you increase your odds of building wealth with less drama.

Types of Index Funds You Should Know

Not all index funds are created the same. Here are some popular flavors you’ll see when you start looking around:

- Stock Market Index Funds: These are the best-known type and track indexes like the S&P 500, Dow Jones, or NASDAQ. They give access to a broad group of companies, usually just in one country.

- Bond Index Funds: These track baskets of government or corporate bonds instead of stocks. They’re less jumpy but typically offer lower returns over the long run.

- International Index Funds: These track companies outside your home country, helpful for extra diversification.

- Sector-Based Index Funds: Want to focus only on a specific part of the market? Sector funds let you zero in on, like technology, healthcare, or energy.

- ESG / Ethical Index Funds: These funds track indexes made up of companies that meet certain standards for environmental, social, and governance practices. Worth checking out if you care how your money is being used behind the scenes.

Some investors even blend several of these types to build a portfolio that matches their goals and comfort level. Exploring options beyond the basic stock index can open up new avenues for growth and stability, depending on your risk tolerance and beliefs.

Benefits of Investing in Index Funds

There’s a reason index funds are a favorite for everyone from beginners to financial advisors. Here are the perks that make them so attractive:

- Low Fees: Index funds cost less to run than actively managed funds, so you usually pay super low fees (sometimes less than 0.1% per year).

- Automatic Diversification: You get broad exposure to lots of companies, cutting down on the risk that comes from putting too much money in one place.

- No Guesswork: Since the fund just follows the index, you don’t have to stress about which stocks to buy or sell.

- Historically Strong Performance: Over long periods, broad market index funds often beat most experts trying to pick winners.

- Beginner Friendly: You don’t need to know much to get started, and you can just “set it and forget it.”

The simplicity of index funds means you can focus on your bigger life goals instead of constantly monitoring the market. The lower costs help ensure that more of your returns actually make it into your pocket long term, instead of being consumed by management fees.

Risks and Limitations of Index Funds

While I’m a big fan of index funds, they aren’t magic. Here’s the not so fun side:

- Market Downturns Still Hurt: If the whole market drops, index funds drop too. They can’t shield you completely during a crash.

- No Supercharged Upside: Since you’re just tracking the market, you won’t “beat” the market, no matter how much you hope to score bigger gains.

- Not Ideal for Short Term Goals: Index funds are built for the long game. If you need your money out in a year or two, the stock market’s short term swings can be tough to handle.

- Emotional Discipline Required: It takes a strong stomach to watch your account drop 20% in a bad year and leave it alone. Emotional decision making hurts returns.

Although index funds reduce your risk compared to picking individual stocks, you’re still tied to the ups and downs of the overall market. Understanding your own risk tolerance and having the patience to ride out tough markets is key to seeing those long term benefits.

How Much Money Do You Need to Start Investing in Index Funds?

The good news is you don’t have to be rich or wait years to start.

Some index funds have minimum investments as low as $100 or even $1, but ETFs that track index funds can usually be bought one share at a time (sometimes for under $50).

Many brokers now let you buy fractional shares, so you can get started with whatever you have spare—even $10.

Fractional Investing: Making It Easy

Fractional investing means you can buy a slice of an index fund or ETF, rather than having to buy a whole share.

This means even small, regular contributions can build up over time.

Small Monthly Contributions Add Up

It’s not about making one huge deposit.

Putting away even $20-$50 a month can make a big difference thanks to compounding, especially if you keep at it for years.

Being consistent matters way more than chasing the perfect moment to invest. Setting up an automated contribution is a smart way to stick to your plan without overthinking every market move.

How Index Funds Help Build Long-Term Wealth

Most people who’ve built wealth with index funds have one thing in common: They let time do the heavy lifting.

Here’s how it plays out:

- Compound Growth Works in Your Favor: Returns you earn get reinvested to earn even bigger returns, creating a snowball effect that can really add up over decades.

- Dollar Cost Averaging Makes It Smoother: By investing a fixed amount every month, you automatically buy more shares when prices drop and fewer when prices are high. Over time, this can reduce your average cost per share (and keep things stress free).

- Realistic Expectations Win: Index funds aren’t get rich quick solutions, they’re more like a slow cooker for your wealth. If you give them 10 or 20 years, you’ll usually end up miles ahead of most folks trying to jump in and out of the market.

Sticking to a set-it-and-forget-it plan with regular investments helps you build discipline, and lets you focus on your other financial goals while your investments work quietly in the background.

The most successful index fund investors know that time and consistency matter much more than trying to catch every market swing.

Are Index Funds Good for Beginners?

In my opinion, index funds work really well for first-time investors, people who don’t want to spend hours researching stocks, and anyone who wants to keep things chill but still see long term growth.

Here are a few things new investors should keep in mind:

- Battling the Urge to “Do Something”: The biggest risk isn’t the fund—it’s you. Panic selling when markets fall (or chasing hot stocks) hurts more than just leaving your money to grow over time.

- Patience Pays: It’s really important to think in years, not days or months. Check your progress every now and then, but don’t obsess over every blip. Trusting in your approach can lead to better outcomes over the long term.

- When to Get Advice: If you have a big chunk of cash, a weird tax situation, or just need some support, chatting with a pro can be really helpful. For most of us though, a simple index fund portfolio does the trick. Don’t be afraid to reach out with questions as you grow more confident in your investing path.

Final Thoughts: Should You Invest in Index Funds?

If you want a way to start investing that’s stress free, low cost, and proven over decades, index funds deserve a spot in your toolkit.

They offer hands off growth, plenty of diversification, and no need for the constant guesswork that comes with picking individual stocks.

Even better, you don’t need a giant bankroll to get going—and with most online brokers offering no minimums or fractional shares, consistency is way more important than size when you’re getting started.

Before making any investment, spend a bit of time learning how the stock market, compounding, and basic investing principles work together.

When you match investing knowledge with good money habits and even build a side hustle or online business, you open the door to real financial independence. Building these habits can put you miles ahead of folks who never get started at all.

If you want a straightforward way to level up your money and online earning skills step by step, check out my top recommended business and investing platform here.

The platform that I joined in 2015 was called Wealthy Affiliate. It helped me during the Covid time, and till this day has helped me to have a solid online business. You can get started for free, and test out the platform,to see if it’s something that you would enjoying doing.

Click on the image below to get your free Starter account.

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

Regards and Take Care

Roopesh