Cash App is a mobile payment platform that offers a bundle of financial features. It enables users to send and receive money, invest in stocks and Bitcoin, and even enjoy some basic banking features like direct deposit.

Developed by Block Inc., which was formerly known as Square, Cash App has grown in popularity, drawing users who value its convenience and simplicity.

The app is designed to be user-friendly and accessible on smartphones, making it a popular choice if you want to handle everyday transactions without the need to visit a traditional bank.

Beyond basic money transfers, Cash App has integrated features that allow users to buy and sell Bitcoin at competitive rates. It has also expanded into the investing arena by allowing individuals to purchase fractional shares of stocks.

This has allowed Cash App to stand out as more than just a digital wallet; it serves as a one-stop solution for anyone looking to manage various aspects of their finances all in one place.

FREE 4-STEP “CHEAT SHEET” :

Want To Build a PROFITABLE Online Business(but don’t know where to start?)

Since its inception, Cash App has continuously added new features and improvements to step up its capabilities.

The minimalistic and intuitive interface helps both novice users and experienced investors handle complex transactions with ease.

The next stage of Cash App is also marked by its innovative branding efforts by Block Inc. The strong track record of its parent company gives users a sense of security, as the app is backed by a publicly listed company.

This corporate backing not only lends credibility to the platform but also suggests that continuous investments are being made in both security and future development.

How safe is the Cash App? Let me show you in the next section.

Is Cash App Safe and Legit?

When it comes to everyday finance, safety is a common concern for many users. In the case of Cash App, financial experts and many users alike agree that the platform is safe and legitimate.

One of the major factors that reinforce the app’s legitimacy is its ownership by Block Inc., a well-known, publicly traded company subject to strict regulatory oversight.

This means that Cash App must adhere to rigorous security protocols and maintain very high standards of data protection.

Many users find reassurance in the fact that Cash App employs robust encryption methods to protect their financial information.

Personal data and transaction details are safeguarded by advanced, all-in-one security practices that help prevent unauthorized parties from intercepting sensitive details.

The dedicated team behind Cash App invests significant resources into reinforcing its digital defenses, which in turn gives users an extra layer of trust when handling their money.

It is important, however, to remain aware that no financial platform is entirely without risk. There is always the potential for scams and fraudulent activities, especially in the current digital landscape where such threats are trending. So, please just be cautious of messages promising free money or those urging them to share confidential information.

Cash App offers a variety of security tips and recommendations on its official website, and one of the best ways to protect yourself is to stay informed and always keep an eye out for suspicious activity.

Moreover, while Cash App is generally considered safe, it does offer only a limited level of buyer protection compared to traditional banks.

This means that in disputes or unauthorized transactions, users might find themselves with fewer recourse. Nonetheless, the combination of reputable corporate backing and in-depth encryption practices ensures that the overall risk for everyday users remains relatively low.

Additional security measures are in place as well. For example, the app frequently updates its systems to counter emerging threats and educate its user base on best practices for online safety.

Pros and Cons of Using Cash App

Like any financial tool, Cash App comes with its own set of advantages and drawbacks.

Its ease of use and broad range of features are major benefits, yet it is important to carefully weigh these pros against some potential downsides before deciding if it meets your financial needs.

Pros:

- A simple and user-friendly interface that makes sending and receiving money straightforward and accessible.

- Instant deposits and transfers enable swift money movement, bypassing many of the delays common with traditional banking.

- The option to invest in Bitcoin and stocks appeals to both casual investors and those interested in more advanced financial maneuvers.

- The free debit card feature makes it easy to make purchases and withdraw funds from ATMs wherever you are.

Cons:

- The customer support system can sometimes be limited, which may delay issue resolution during urgent situations.

- There is an identifiable risk of scams, especially those that mimic Cash App giveaways or fraudulent requests, which means users must exercise extra caution.

- Cash App might not be the best choice for larger business transactions or those requiring more robust banking features for high-volume financial operations.

While the advantages tend to make Cash App a compelling option for everyday use, it is equally critical to understand and consider the possible pitfalls.

If you are planning to depend heavily on the platform for significant transactions or business matters, these drawbacks could have a greater impact on your overall experience.

Cash App Features Breakdown

Cash App has expanded its suite of features far beyond basic money transfers, aiming to become an all-in-one financial tool.

Here is a detailed look at the core functionalities that the app currently provides:

Sending and Receiving Money:

This is the very heart of Cash App.

Whether you are splitting a bill at a restaurant or repaying a friend for a coffee, the process is as easy as initiating a transaction within the app.

Users can link their bank accounts or debit cards to fund these transactions, and funds received are usually available for immediate use. This ease of use helps bring financial transactions to life, reducing the friction usually associated with transferring money.

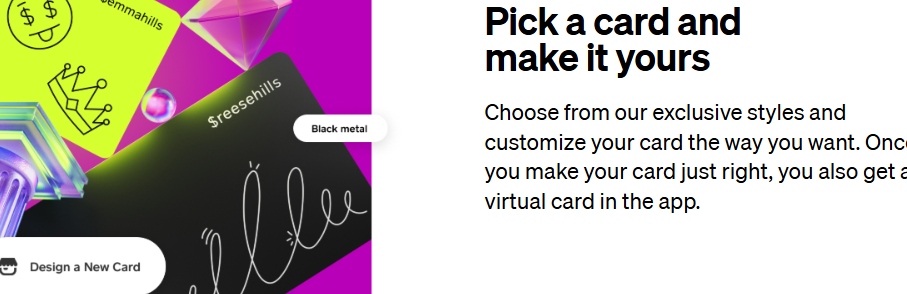

Cash App Card:

The Cash App Card is a standout feature that distinguishes the platform from similar services. This free debit card provides users with direct access to their Cash App balance and can be used for in-store and online purchases as well as ATM withdrawals.

The physical card seamlessly integrates with the digital experience, offering convenience and flexibility to those on the move.

Boost Offers (Discount Perks):

Boost offers represent one of the more innovative elements of Cash App. Users can choose from a selection of discount deals available at various retailers. Once activated, these boosts provide instant savings when using the Cash App Card for purchases at participating merchants.

By offering these instant discount perks, Cash App not only helps users save money but also encourages them to continue using the Cash App Card for daily transactions.

Direct Deposit:

Another practical feature is the ability to set up direct deposit for paychecks. With direct deposit, your salary or wages are sent directly into your Cash App account, granting faster access to funds compared to traditional banking systems. The process is straightforward and can typically be arranged through your employer by providing the necessary banking details.

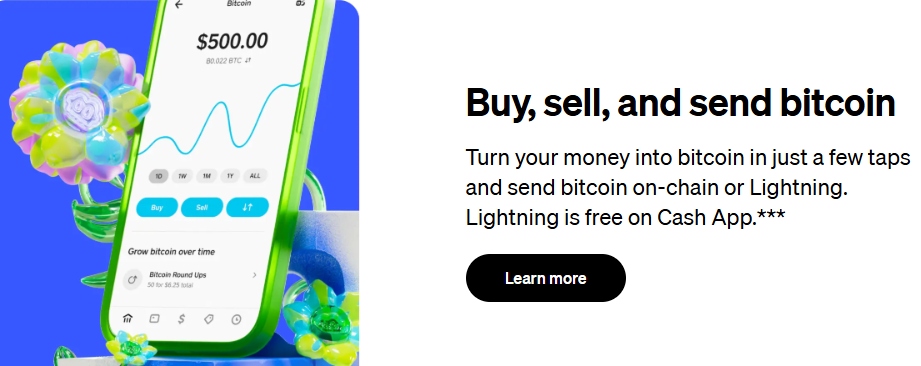

Bitcoin Buying and Selling:

A particularly attractive feature for tech-savvy users is the ability to buy and sell Bitcoin directly within the app. Although the cryptocurrency market can be volatile, Cash App provides a user-friendly interface that simplifies the process of engaging with digital currencies.

This option allows users to convert dollars into Bitcoin and vice versa, offering an accessible introduction to cryptocurrency investing without the complexity of a traditional trading platform.

Investing in Stocks:

Not limited to Bitcoin, Cash App also allows its users to invest in stocks without the need to open a full brokerage account.

This feature is especially appealing for beginners who want to test the waters of the stock market without diving into the complexities typically associated with stock trading.

By enabling the purchase of fractional shares of popular stocks, Cash App makes investing more accessible and less intimidating.

In addition to these core functionalities, the app offers a range of supplementary features designed to streamline personal finance management.

These include cash boosts on everyday purchases, real-time notifications about transaction statuses, and the flexibility to link multiple bank accounts.

Together, these features work to simplify regular banking tasks while opening up avenues for exploring investment opportunities in a straightforward and intuitive environment.

Recent updates have also introduced enhancements to the user interface, making it even easier to find and use these features.

Who Is Cash App Best For?

Cash App caters to a wide variety of users, but it is particularly appealing for individuals engaging in casual transactions and light financial management.

Freelancers, gig workers, and side hustlers often find the app incredibly useful because of its quick deposit and transfer capabilities. If you frequently need to split bills or make payments to friends and family, the simplicity of Cash App is a significant advantage.

If you are new to investing, the app provides a welcoming entry point into the world of stocks and cryptocurrencies. The ability to purchase fractional shares and small amounts of Bitcoin makes it easier to get started without a large financial commitment.

This ease of access helps demystify the investment process and encourages users to gradually build their financial portfolios.

Moreover, Cash App is especially well-suited for individuals who appreciate managing all their finances within a single, integrated app.

It offers a unified experience that covers everyday transactions as well as basic investing, making it an attractive option for those who value convenience over multifunctional business tools.

However, it may not be ideal for larger businesses or for individuals who require more advanced and nuanced banking features for high-value transactions.

In addition, many users find the quick turnaround of funds as a brilliant solution for managing irregular incomes.

This makes Cash App particularly beneficial in scenarios where waiting for bank processing times is not an option. The platform’s flexibility and user-friendly experience ensure that both novices and seasoned users can benefit from its features without feeling overwhelmed.

Cash App Alternatives

While Cash App offers a unique mixture of functionalities, it is always worthwhile to consider some alternatives to ensure you get the right fit for your financial needs. Here are a few popular options:

PayPal:

PayPal is a longstanding player in the online payment industry and is known for both its widespread usage and international capabilities.

PayPal supports both personal and business transactions with features such as buyer protection and effective dispute resolution systems, which many users consider a major advantage.

Venmo:

Owned by PayPal, Venmo is similar to Cash App in that it emphasizes peer-to-peer transactions. Its social feed feature allows users to see transactions among friends, which some find engaging and interactive.

However, there have been privacy concerns raised about Venmo, so if privacy is paramount for you, this is an important factor to consider.

Wise:

Formerly known as TransferWise, Wise is an alternative that stands out particularly for international transactions.

With low fees and transparent conversion rates, Wise is popular for sending money abroad. If you frequently remit payments across borders, researching Wise might provide insights into a more cost-effective solution for global financial transactions.

Final Verdict – Is Cash App Worth It?

Taking all factors into account, I find that Cash App is generally worth it for casual financial use. The platform offers a convenient and accessible way to send and receive money, while the added benefits of Bitcoin trading and stock investing introduce additional value.

For individuals who use the app primarily for personal transactions or introductory investing, its ease of use, quick transfer times, and intuitive features make it an attractive option.

However, it is important to approach Cash App with some caution. The platform is not designed for heavy business transactions or for users who require very robust buyer protection.

The simplicity that makes Cash App appealing for everyday use could also prove to be a limitation when faced with more complex financial matters. In addition, the often limited customer support can be challenging if immediate assistance is needed during critical times.

For freelancers, side hustlers, and beginner investors, Cash App represents an accessible and straightforward financial tool. Provided that you use it for transactions that align with its strengths and always stay sharp against potential scams, you should find significant value in the platform

In contrast, if you manage large-scale transactions or need comprehensive fraud protection measures, it might be beneficial to explore alternative options designed to meet those specific needs.

Before I leave you with some with some important frequently asked question below, check out my one recommendation if you are new to the online world, and are looking for a way to make REAL money online.

Free Access to the STARTER MEMBERSHIP which includes:

- 8-lesson core niche training

- WA help/community access (2.5 + million members)

- 7 days of coaching/mentoring from me

- And more…

FAQs

Is Cash App a bank?

No, Cash App is not a bank. It functions as a payment platform that allows you to send and receive money, invest in stocks, and handle Bitcoin transactions.

Although it offers some banking-like features such as direct deposit, it does not provide the full range of protections and services typically associated with a traditional banking institution.

Can I use Cash App internationally?

Currently, Cash App is primarily designed for users in the United States and the United Kingdom.

While there have been some limited international features introduced recently, most of its functionalities are optimized for domestic transactions. If you need to send money internationally on a regular basis, you may want to consider alternatives like Wise or PayPal.

What fees should I expect when using Cash App?

Cash App is recognized for its straightforward fee structure. While sending money between friends or family is often free of charge, there can be fees for certain services.

For example, instant deposits or Bitcoin transactions might incur a small fee. It is advisable to review the latest fee schedule on the Cash App website or within the app, as these rates are subject to change over time.

Is my money protected on Cash App?

Cash App employs strong encryption and security measures to protect your financial information. However, since it is not a traditional bank, the buyer protection and dispute resolution processes might be more limited. It is crucial to exercise caution and only send money to individuals you trust, as well as to follow recommended security practices to protect your funds.

How to Avoid Scams When Using Cash App

Given the ongoing rise in digital scams and fraudulent schemes, being cautious is important for any Cash App user. Scammers often target mobile payment platforms like Cash App through various deceptive tactics such as fake giveaways or fraudulent requests for personal information.

Staying informed and cautious goes a long way in preventing financial mishaps. Always verify transaction requests and never share your PIN or password with anyone. Official Cash App resources offer a wealth of guidance on identifying suspicious activity, and taking time to read and follow these guidelines can sharply reduce your chances of falling victim to fraud.

It also helps to regularly monitor your account activity. If you observe any unusual transactions, immediately reach out to Cash App support. Although customer service may sometimes be slow during peak times, taking prompt action is essential for keeping your finances secure. Remember, the onus is ultimately on the user to adopt safe practices, so staying sharp is a necessity in today’s digital world.

For added safety, consider setting up additional verification methods and using strong passwords. Educating yourself about common scam techniques, and sharing that information with friends and family, can foster a community-wide approach to mitigating risks.

Practical Tips for Maximizing Your Use of Cash App

Here are a few practical tips to truly get the most out of your Cash App experience. First, take some time to explore the full range of features beyond just basic money transfers.

If you decide to check out investments, it might be best to start small and gradually build up your exposure as you become more comfortable with market fluctuations. Every investment carries risks, so it is wise to learn at your own pace while only putting in amounts you are okay with potentially losing.

Second, always ensure that you update the app regularly. New updates not only introduce additional features but also bring important security patches to keep your financial data safe. An updated app means you are benefiting from the latest technical improvements and security enhancements that help keep your transaction history secure.

Another tip is to take advantage of the Boost offers available through the Cash App Card. These eye-catching discount perks can help reduce everyday spending and provide a welcome boost to your finances. Additionally, maintaining a regular habit of reviewing your transaction history and monitoring account activity is a surefire way to keep your finances in check.

Finally, keep yourself informed by subscribing to official Cash App communications. These updates include changes in policy, fee adjustments, and new feature rollouts that could be directly relevant to your financial decisions. Being proactive and informed is really important for managing your money safely and effectively in a digital environment.

My Final Thoughts

After examining all facets of Cash App—from its wide-ranging core features and security measures to its potential drawbacks—I believe the platform adds real value for everyday financial activities.

For casual transactions, quick transfers, and introductory investing, Cash App provides a streamlined and user-friendly experience that is hard to beat.

The beauty of Cash App lies in its ability to bring together multiple financial functions within one simple interface. This makes it an ideal choice for individuals who value convenience and ease of use over the extensive technical features found in traditional banking apps.

As digital payments and fintech innovations continue to evolve, Cash App is likely to introduce even more features that resonate with modern users. With continuous improvements in security and additional service offerings on the horizon, the potential next stage for Cash App looks both promising and exciting.

For anyone exploring the world of mobile transactions and investment apps, keeping informed and cautious will always yield benefits.

This isn’t just about making transfers or sending money – it’s about embracing a new way to manage your financial life, one that combines convenience, innovation, and a commitment to security.

Whether you use it for everyday transactions or to experiment with digital assets, Cash App offers an integrated approach that can help simplify your financial journey.

Thanks for checking out my Cash App review.

I hope that it has helped you out.

Regards and Take Care

Roopesh