Have you ever been told you can earn passive income in South Africa simply by sharing an app? If you’ve found yourself searching for details on the DuePoint business, you’re not alone.

There’s a lot of curiosity (and skepticism) around multilevel marketing in South Africa, especially when it comes to big promises of wealth by recruiting others.

I’ve dug into DuePoint’s system, talked to real users, analyzed their compensation plan, and checked their licensing to give you the real story on whether this is a legitimate side hustle or just another pyramid-style setup.

Company Name: DuePoint

Website: DuePoint.net

Monthly Fees: R299/month minimum

Founding Year: 2016

Headquarters: Johannesburg, South Africa

Parent Company: Constantia Insurance Company

FSCA/FSP Number: 15261

Membership Title: “Wealth Engineers”

Main Offer: Referral-based recurring commissions on financial services and insurance subscriptions

My Number One Recommendation: Check It Out Here

DuePoint has built a lot of hype by inviting South Africans to “create wealth” via its modern, app-driven MLM setup.

It’s got a financial license, established insurance backing, and a slick mobile platform. But there are still some pretty important things to know before paying a single rand or inviting friends to sign up.

FREE 4-STEP “CHEAT SHEET” :

Want To Build a PROFITABLE Online Business(but don’t know where to start?)

About DuePoint: The Company, the License, and Who Runs It

DuePoint started up in 2016, operating out of Johannesburg. They’re part of the larger Constantia Insurance stable, a well-established South African insurance group that’s been around for decades. That’s a pretty big tick for credibility, at least compared to a lot of shadowy MLMs out there.

DuePoint is officially licensed as a Financial Services Provider (FSP 15261) with the FSCA, which is the top regulatory body for financial services in South Africa.

This means they’re supposed to stick to legal boundaries when selling products like insurance, wealth education, and funeral cover.

According to their marketing, their mission is all about “lifting South Africans with recurring, residual income,” mainly by referring new customers to their insurance and financial products via a dedicated app.

I found it interesting that their core message isn’t selling insurance for its own sake, but getting as many people as possible to subscribe to these products, and then having those people bring in even more people so that everyone in the chain can earn recurring commissions for as long as their downline stays subscribed. That’s where the typical MLM flavor starts showing up.

Recommended Reading: Prosperity Of Life Review – Breakthrough Program Or High-Ticket Trap?

How DuePoint Works: App, XP Points, and Monthly Fees

The promise from DuePoint is that you can make money by building a “team” and helping others sign up for a recurring subscription using their app.

Earnings don’t come from just selling, but also from recruiting new paying members.

Here’s how the system fits together:

- Subscription Requirement: To qualify for earnings, every member (or “Wealth Engineer”) must pay a monthly fee, usually R299 or more, depending on the products they choose. This covers things like wealth protection services or education.

- Recruitment is Key: The more people you sign up, and the more people those people sign up (and so on), the bigger your potential compensation.

- App Tracking: The DuePoint app is where members manage their referrals, view their “XP” (Experience Points), and check earnings. It also handles training modules and tracks your business performance in real-time.

- Product Mix: Most “products” are insurance-based: funeral cover, creditor protection, legal cover, and education products related to wealth building. There isn’t much physical product or one-off retail sale involved.

- XP Points: Activity inside the app (like attending training, inviting others, or reaching performance targets) earns XP points. These points affect your “rank” in the system, which in turn determines your commission level and unlocks additional bonuses.

- Team Building: To maximize your income, you’re encouraged to keep bringing in new people AND train your team’s recruits to do the same—classic MLM stacking style.

While the tech side of DuePoint is pretty modern, the process itself feels familiar to anyone who’s looked at network marketing.

The focus isn’t really on getting people to buy retail products. It’s about getting as many subscribed, paying team members into your “business” as possible, and then helping them do the same.

DuePoint Compensation Plan: How Do You Earn?

Breaking down the DuePoint compensation plan can be a headache at first, but here’s the basic flow:

- Direct Referral Commissions: You get a fixed rand amount each month for every direct recruit who pays their monthly subscription, and a smaller amount for indirect recruits (those brought in by your team members, up to 8 levels deep).

- XP and Rank: XP Points determine your Wealth Engineer Rank. Reaching higher XP milestones unlocks higher commission rates, “rankup” bonuses, and sometimes once-off rewards like gadgets or travel incentives.

- Team Structure: Commissions are paid deeper as your team grows wider and deeper, but a lot of the payout potential is locked behind recruiting more and more active (paying) members into the system.

- Product Mix: The more products your referrals subscribe to, the more commission you can get. But subscriptions have to stay active. If your team stops paying, your monthly earnings shrink fast.

DuePoint does not guarantee income for anyone. Their documentation is upfront about that.

Most potential comes from growing a large, paying team, not from actually selling someone a one-time policy.

This is key to understanding why the platform raises concerns about being pyramidlike, even though it’s technically legal and has real products in the insurance space.

Is DuePoint a Pyramid Scheme or a Legit MLM?

Here’s where things get interesting.

Every network marketing company says it isn’t a pyramid, but with DuePoint, that’s a hot topic across South African forums and Facebook groups.

So, what separates a legal MLM from a pyramid?

Pyramid schemes pay mainly for recruitment, with little or no real product or service exchange. They usually collapse when recruitment dries up. Legit MLMs, by contrast, get most revenue from actual product sales to outside customers, not endless internal recruitment.

Arguments often made for DuePoint’s legitimacy:

- They sell real financial and insurance products that people can use, not just access to the compensation plan.

- They have an FSCA license (which you can verify on the FSCA website).

- They clearly warn that income isn’t guaranteed, and payouts depend on team performance and subscriptions staying active.

Arguments that make people cautious:

- The real focus isn’t a product, it’s paying monthly and getting others to pay too.

- There are almost no retail customers who just buy products without joining the income opportunity.

- To earn, you’re pushed to keep recruiting and keep everyone subscribed, making it feel pyramid-shaped in practice.

So, while DuePoint is technically legal in South Africa thanks to its FSCA registration and insurance roots, most successful members are the most aggressive recruiters.

Careful research helps new members make more informed choices, and it’s really important to understand the risks before paying any signup fees.

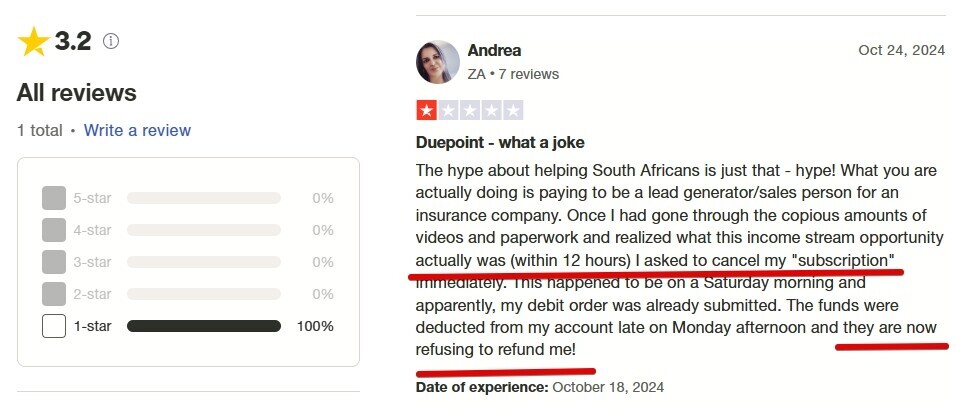

Real User Experiences: Reviews, Complaints & Tips

I’ve read through a heap of user reviews (Facebook, HelloPeter, Reddit, personal blogs) and talked to some South Africans who’ve tried building a DuePoint business firsthand.

Here’s the mix of what I hear:

Positive Feedback

- Training & Support: Many members say the online resources and live presentations are helpful, especially for beginners in sales or insurance.

- App Platform: People like how the app tracks their earnings, provides motivating prompts, and helps manage leads on the go.

- Payout Reliability: Several long-term recruiters report getting consistent monthly commissions for teams who keep up their subscriptions.

Common Complaints and Risks

- Limited Income for Most: The vast majority of participants make little to nothing monthly (especially those who don’t recruit new members constantly).

- Bans & Account Suspensions: Some report sudden bans due to breaching “compliance” (like making income claims online), with little recourse.

- High Churn: Teams shrink quickly if recruits stop paying monthly; recurring income only lasts if you’re constantly bringing fresh members in.

- Negative Forum Threads: DuePoint is discussed in Reddit threads such as this one, with users cautioning about the difficulty of making any real profit unless you’re among the top recruiters.

My personal feeling: DuePoint seems best for those who genuinely love team building and are willing to hustle full-time to keep growing their base. Anyone hoping for hands-free, steady “passive income” could be let down, especially if they’re not natural networkers.

Pros and Cons of the DuePoint MLM Model

After picking apart both the company itself and loads of reviews, here’s what pops out:

Pros

- Backed by a regulated insurance company

- Licensed by the FSCA, not operating in the shadows

- Modern app makes tracking and training pretty easy

- Recurring, potentially passive income for high-performing recruiters

- No stockpiling or physical product hassles

Cons

- Mandatory monthly fee (minimum R299) just to participate and qualify for earnings

- Income depends mainly on non-stop recruitment and keeping teams motivated

- No real product ownership or classic brand-building

- Lots of effort needed for unpredictable (and often low) rewards

- Easy to lose recurring income if your team stops subscribing

- Feels pyramid-like, even if technically legal

For me, the heavy reliance on recruitment and forced monthly participation makes this a tough model for most people to win big unless they’re really plugged into large networks.

Who Should Consider DuePoint?

DuePoint isn’t for everyone, but there’s a crowd that could find value:

- Network Marketers: People who enjoy building and motivating teams and are comfortable recruiting friends, family, and strangers.

- Insurance Agents: Those already selling insurance can use DuePoint as an extra income stream without extra compliance headaches.

- Confident Social Sellers: People who love using social media and don’t mind pitching the business opportunity a lot.

- South Africans Looking for Flexible, MobileFirst Side Hustles: If you’re tech-savvy and already have a broad network, it could suit you, just go in with realistic expectations.

- Those with a High Tolerance for Unstable Earnings: Many months may pay littletothing unless your team stays strong and growing.

If cold selling or regular recruiting sounds stressful, or if you want a business that’s more about building your brand or owning customers, I’d check out some alternatives first.

Alternatives to DuePoint for South African Side Hustlers

This type of MLM isn’t the only remote earning angle out there.

If you want to avoid mandatory fees, recruiting pressure, or an insurance focus, these tried and tested options could suit you:

- Master Affiliate Profits: High-ticket digital affiliate model, no product stocking, and no recruitment pyramid. You promote valuable info products and earn one-off or recurring commissions without pressure to build a downline. Check it out here.

- Wealthy Affiliate: Established platform offering step-by-step training, website hosting, and access to a huge variety of affiliate programs. Great for those who want to learn digital marketing and build their brand, not someone else’s. You can start free, and there’s no forced recurring product purchase.

- Invincible Marketer: Solid training and evergreen affiliate marketing strategies, focused on long-term income streams (no MLM structure, no pressure to recruit anyone). Read my review here.

- Traditional Insurance Brokerage: For those familiar with insurance, consider a standard independent broker route. You get to build a client base, control your brand, and avoid the MLM-stylethat is monthly fees.

There’s a lot more out there than network marketing, especially if you’re willing to learn some digital marketing, build your skills, and focus on reaching real customers instead of endless recruitment cycles.

Final Verdict: Is DuePoint Worth It in 2025?

DuePoint is one of the few South African MLMs that is properly regulated and has a known insurance group behind it.

That alone makes it more trustworthy than a lot of sketchy “cash gifting” or “passive income” scams. But here’s the real question: can it deliver real, lasting income for the average person?

If you’re outgoing, love motivating teams, and don’t mind facing lots of rejection or turnover, DuePoint could provide a side income. But so much of the earning power comes from nonstop recruiting, not from retail product sales or “useful” financial services alone. That makes income pretty unstable for most.

I recommend looking at lower-risk affiliate models first. There’s no monthly fee, less recruitment pressure, and you can build your brand. At worst, you lose some time learning. With DuePoint, your risks are paid monthly, even if you (or your downline) never see lasting rewards.

Frequently Asked Questions About DuePoint

Is DuePoint legal in South Africa?

Yes, DuePoint is legal and licensed by the Financial Sector Conduct Authority (FSCA). They operate as an FSP (FSP number 15261) and offer products regulated by the South African insurance industry. This puts them well ahead of schemes that have no regulatory oversight.

Can you make money with DuePoint?

Some members earn recurring commissions by building large, active teams. However, most members earn little or nothing, especially if they don’t recruit new paying members consistently. Only a small percentage of “Wealth Engineers” see decent monthly payouts.

How do I withdraw earnings from DuePoint?

Once you meet the minimum withdrawal threshold (usually R100), you can request a payout directly to your South African bank account through the app or web dashboard. All commissions are paid monthly, but active, qualifying status is required to be eligible for the payout.

What happens if I stop paying the monthly fee?

If you cancel your monthly subscription, you lose active status. You stop earning commissions, lose access to member resources, and essentially “pause” your business. Any unpaid commissions will be forfeited or held until you reactivate, based on DuePoint’s latest terms.

How much can you earn with DuePoint?

Income varies a lot. DuePoint shares examples of top earners making several thousand rand monthly, but acknowledges that these are rare and depend on building (and maintaining) a large, constantly growing team. Churn is high, and there’s no guarantee beyond what you and your team can achieve.

Hopefully, you found this breakdown super helpful. If you want to check out safer ways to build an online income in South Africa (without the pyramid risk), it’s worth looking at established affiliate programs or training platforms.

Feel free to drop your questions below or reach out directly. I’m always happy to help explore earning options that fit best for you!